Summary

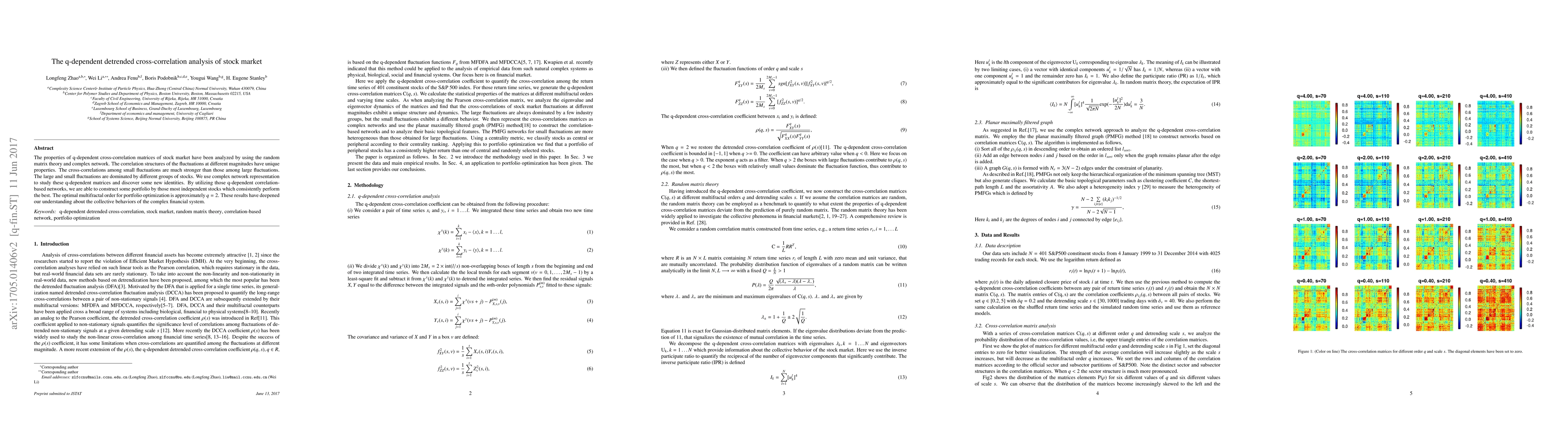

The properties of q-dependent cross-correlation matrices of stock market have been analyzed by using the random matrix theory and complex network. The correlation structures of the fluctuations at different magnitudes have unique properties. The cross-correlations among small fluctuations are much stronger than those among large fluctuations. The large and small fluctuations are dominated by different groups of stocks. We use complex network representation to study these q-dependent matrices and discover some new identities. By utilizing those q-dependent correlation-based networks, we are able to construct some portfolio by those most independent stocks which consistently perform the best. The optimal multifractal order for portfolio optimization is approximately $q=2$. These results have deepened our understanding about the collective behaviors of the complex financial system.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)