Summary

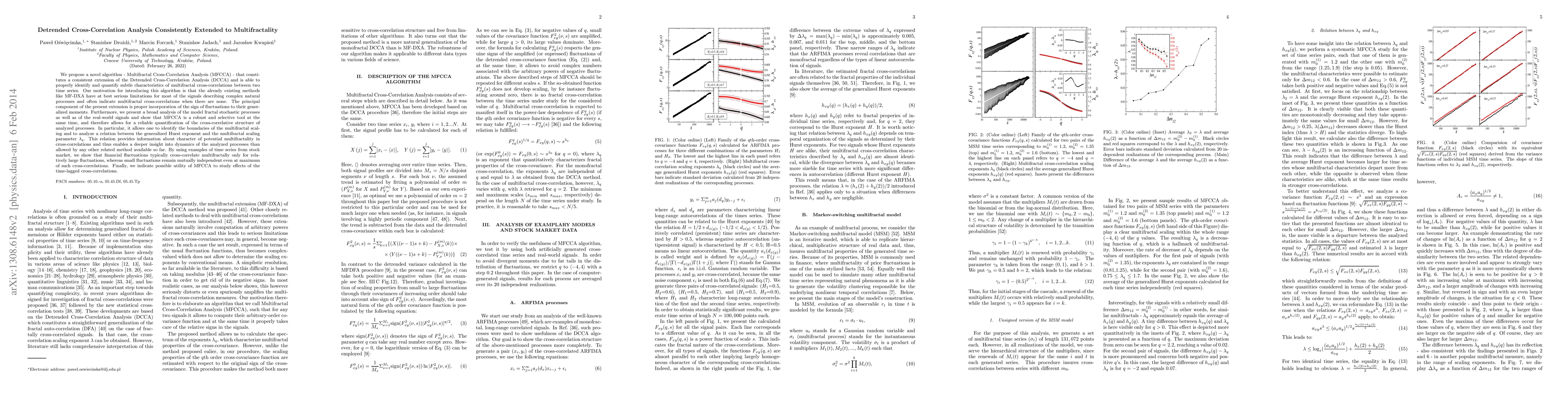

We propose a novel algorithm - Multifractal Cross-Correlation Analysis (MFCCA) - that constitutes a consistent extension of the Detrended Cross-Correlation Analysis (DCCA) and is able to properly identify and quantify subtle characteristics of multifractal cross-correlations between two time series. Our motivation for introducing this algorithm is that the already existing methods like MF-DXA have at best serious limitations for most of the signals describing complex natural processes and often indicate multifractal cross-correlations when there are none. The principal component of the present extension is proper incorporation of the sign of fluctuations to their generalized moments. Furthermore, we present a broad analysis of the model fractal stochastic processes as well as of the real-world signals and show that MFCCA is a robust and selective tool at the same time, and therefore allows for a reliable quantification of the cross-correlative structure of analyzed processes. In particular, it allows one to identify the boundaries of the multifractal scaling and to analyze a relation between the generalized Hurst exponent and the multifractal scaling parameter $\lambda_q$. This relation provides information about character of potential multifractality in cross-correlations and thus enables a deeper insight into dynamics of the analyzed processes than allowed by any other related method available so far. By using examples of time series from stock market, we show that financial fluctuations typically cross-correlate multifractally only for relatively large fluctuations, whereas small fluctuations remain mutually independent even at maximum of such cross-correlations. Finally, we indicate possible utility of MFCCA to study effects of the time-lagged cross-correlations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)