Summary

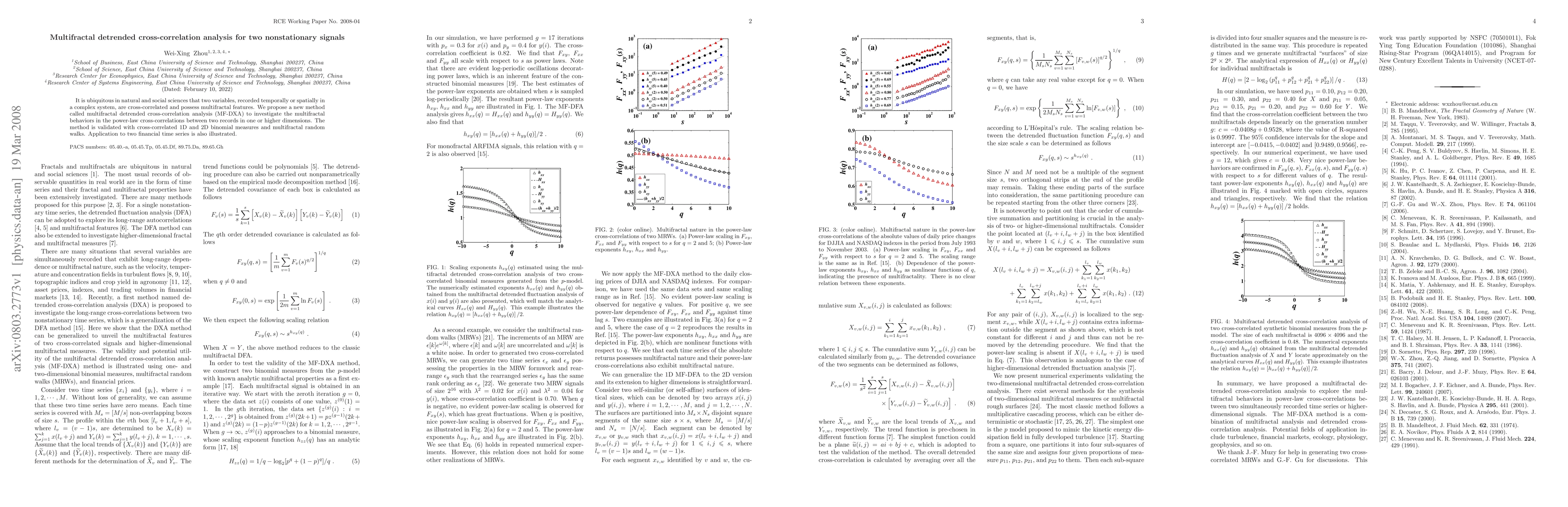

It is ubiquitous in natural and social sciences that two variables, recorded temporally or spatially in a complex system, are cross-correlated and possess multifractal features. We propose a new method called multifractal detrended cross-correlation analysis (MF-DXA) to investigate the multifractal behaviors in the power-law cross-correlations between two records in one or higher dimensions. The method is validated with cross-correlated 1D and 2D binomial measures and multifractal random walks. Application to two financial time series is also illustrated.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)