Summary

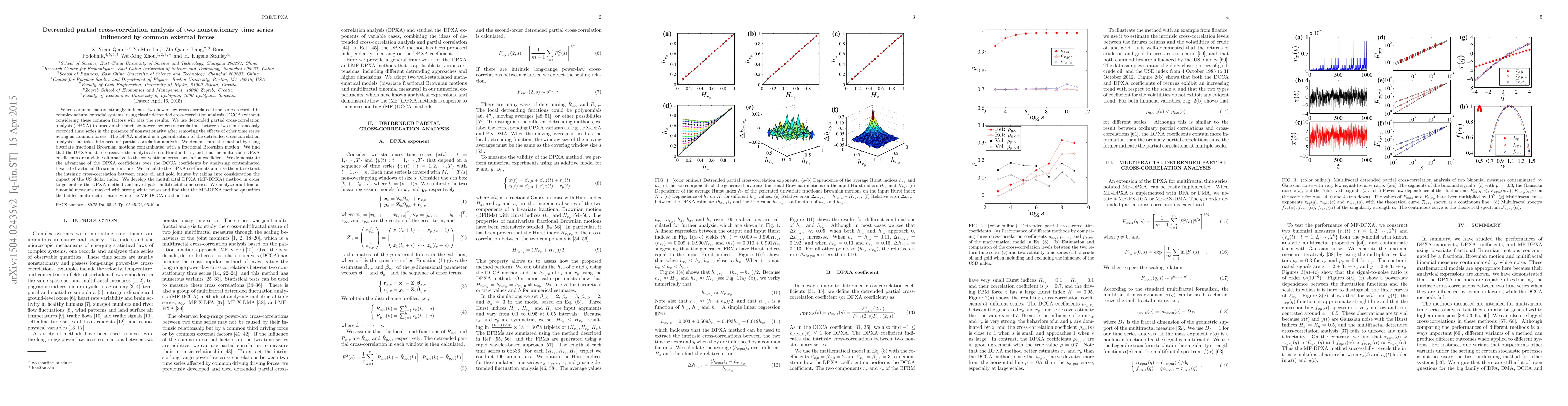

When common factors strongly influence two power-law cross-correlated time series recorded in complex natural or social systems, using classic detrended cross-correlation analysis (DCCA) without considering these common factors will bias the results. We use detrended partial cross-correlation analysis (DPXA) to uncover the intrinsic power-law cross-correlations between two simultaneously recorded time series in the presence of nonstationarity after removing the effects of other time series acting as common forces. The DPXA method is a generalization of the detrended cross-correlation analysis that takes into account partial correlation analysis. We demonstrate the method by using bivariate fractional Brownian motions contaminated with a fractional Brownian motion. We find that the DPXA is able to recover the analytical cross Hurst indices, and thus the multi-scale DPXA coefficients are a viable alternative to the conventional cross-correlation coefficient. We demonstrate the advantage of the DPXA coefficients over the DCCA coefficients by analyzing contaminated bivariate fractional Brownian motions. We calculate the DPXA coefficients and use them to extract the intrinsic cross-correlation between crude oil and gold futures by taking into consideration the impact of the US dollar index. We develop the multifractal DPXA (MF-DPXA) method in order to generalize the DPXA method and investigate multifractal time series. We analyze multifractal binomial measures masked with strong white noises and find that the MF-DPXA method quantifies the hidden multifractal nature while the MF-DCCA method fails.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)