Summary

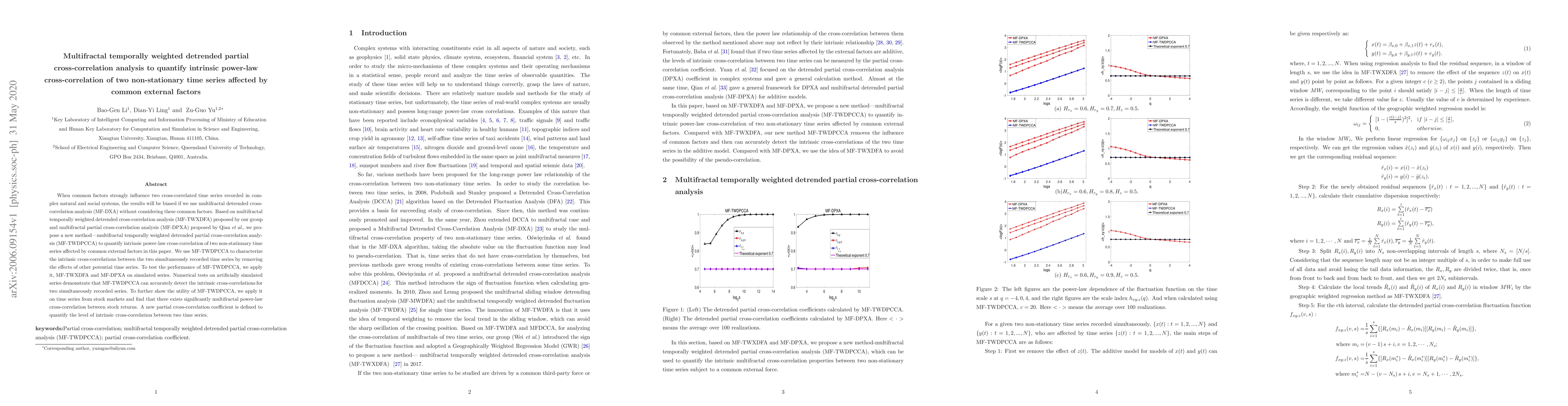

When common factors strongly influence two cross-correlated time series recorded in complex natural and social systems, the results will be biased if we use multifractal detrended cross-correlation analysis (MF-DXA) without considering these common factors. Based on multifractal temporally weighted detrended cross-correlation analysis (MF-TWXDFA) proposed by our group and multifractal partial cross-correlation analysis (MF-DPXA) proposed by Qian et al., we propose a new method---multifractal temporally weighted detrended partial cross-correlation analysis (MF-TWDPCCA) to quantify intrinsic power-law cross-correlation of two non-stationary time series affected by common external factors in this paper. We use MF-TWDPCCA to characterize the intrinsic cross-correlations between the two simultaneously recorded time series by removing the effects of other potential time series. To test the performance of MF-TWDPCCA, we apply it, MF-TWXDFA and MF-DPXA on simulated series. Numerical tests on artificially simulated series demonstrate that MF-TWDPCCA can accurately detect the intrinsic cross-correlations for two simultaneously recorded series. To further show the utility of MF-TWDPCCA, we apply it on time series from stock markets and find that there exists significantly multifractal power-law cross-correlation between stock returns. A new partial cross-correlation coefficient is defined to quantify the level of intrinsic cross-correlation between two time series.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDissecting Multifractal detrended cross-correlation analysis

Borko Stosic, Tatijana Stosic

No citations found for this paper.

Comments (0)