Summary

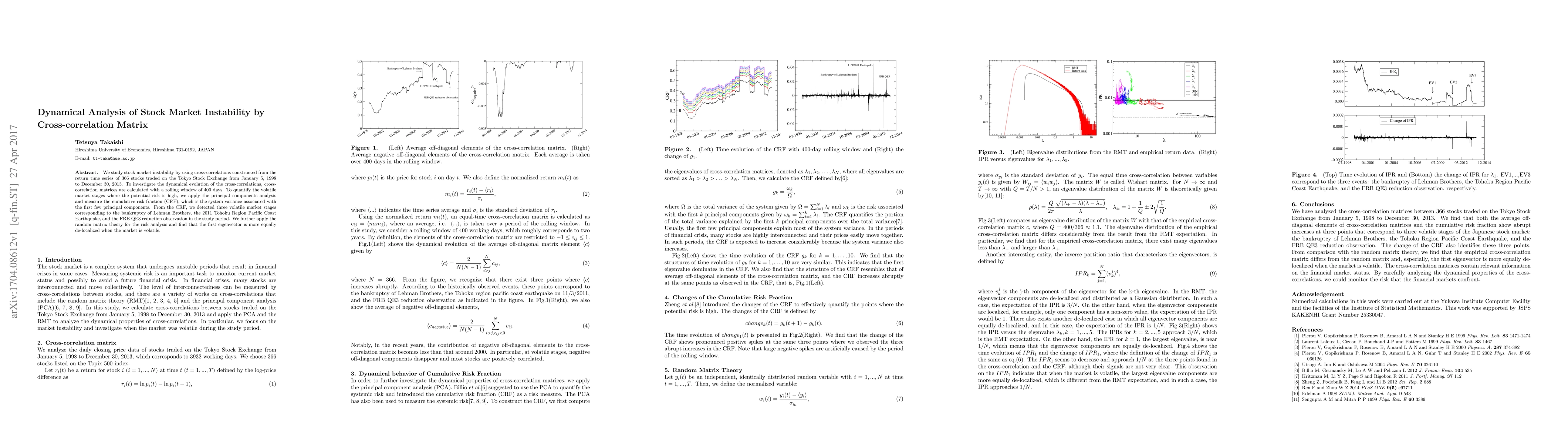

We study stock market instability by using cross-correlations constructed from the return time series of 366 stocks traded on the Tokyo Stock Exchange from January 5, 1998 to December 30, 2013. To investigate the dynamical evolution of the cross-correlations, cross-correlation matrices are calculated with a rolling window of 400 days. To quantify the volatile market stages where the potential risk is high, we apply the principal components analysis and measure the cumulative risk fraction (CRF), which is the system variance associated with the first few principal components. From the CRF, we detected three volatile market stages corresponding to the bankruptcy of Lehman Brothers, the 2011 Tohoku Region Pacific Coast Earthquake, and the FRB QE3 reduction observation in the study period. We further apply the random matrix theory for the risk analysis and find that the first eigenvector is more equally de-localized when the market is volatile.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCross-Lingual News Event Correlation for Stock Market Trend Prediction

Seemab Latif, Rabia Latif, Sahar Arshad et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)