Summary

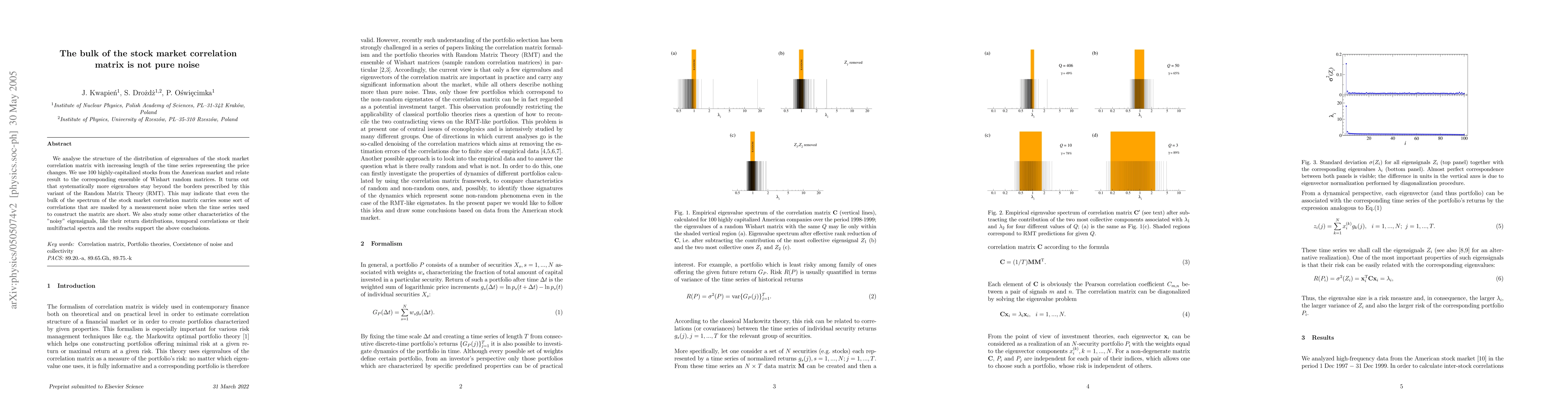

We analyse the structure of the distribution of eigenvalues of the stock market correlation matrix with increasing length of the time series representing the price changes. We use 100 highly-capitalized stocks from the American market and relate result to the corresponding ensemble of Wishart random matrices. It turns out that systematically more eigenvalues stay beyond the borders prescribed by this variant of the Random Matrix Theory (RMT). This may indicate that even the bulk of the spectrum of the stock market correlation matrix carries some sort of correlations that are masked by a measurement noise when the time series used to construct the matrix are short. We also study some other characteristics of the "noisy" eigensignals, like their return distributions, temporal correlations or their multifractal spectra and the results support the above conclusions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)