Summary

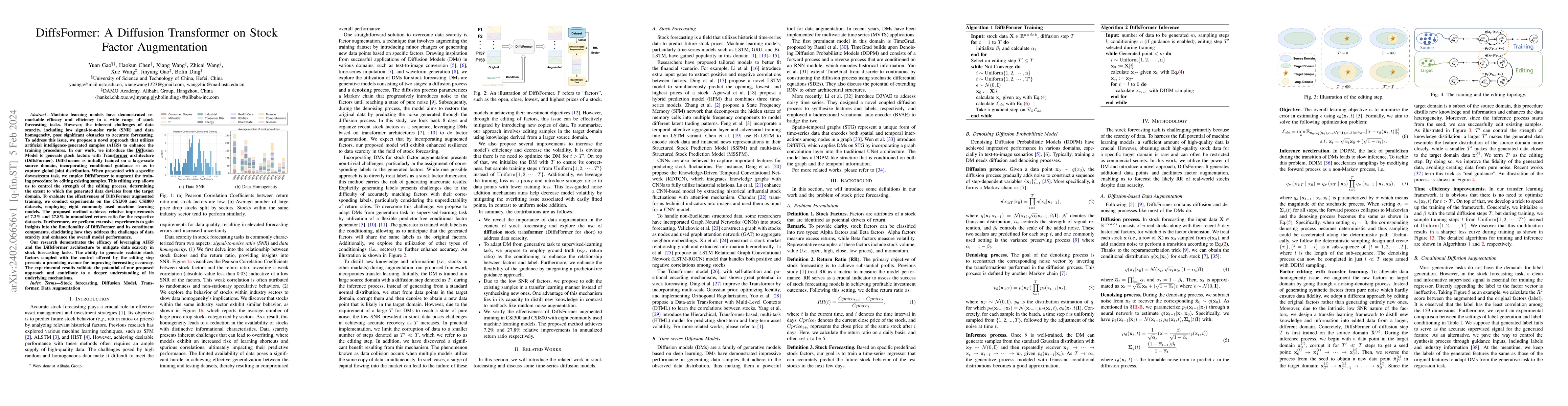

Machine learning models have demonstrated remarkable efficacy and efficiency in a wide range of stock forecasting tasks. However, the inherent challenges of data scarcity, including low signal-to-noise ratio (SNR) and data homogeneity, pose significant obstacles to accurate forecasting. To address this issue, we propose a novel approach that utilizes artificial intelligence-generated samples (AIGS) to enhance the training procedures. In our work, we introduce the Diffusion Model to generate stock factors with Transformer architecture (DiffsFormer). DiffsFormer is initially trained on a large-scale source domain, incorporating conditional guidance so as to capture global joint distribution. When presented with a specific downstream task, we employ DiffsFormer to augment the training procedure by editing existing samples. This editing step allows us to control the strength of the editing process, determining the extent to which the generated data deviates from the target domain. To evaluate the effectiveness of DiffsFormer augmented training, we conduct experiments on the CSI300 and CSI800 datasets, employing eight commonly used machine learning models. The proposed method achieves relative improvements of 7.2% and 27.8% in annualized return ratio for the respective datasets. Furthermore, we perform extensive experiments to gain insights into the functionality of DiffsFormer and its constituent components, elucidating how they address the challenges of data scarcity and enhance the overall model performance. Our research demonstrates the efficacy of leveraging AIGS and the DiffsFormer architecture to mitigate data scarcity in stock forecasting tasks.

AI Key Findings

Generated Sep 02, 2025

Methodology

The research introduces DiffsFormer, a conditional diffusion Transformer framework for stock forecasting that focuses on augmenting time-series stock data with the help of label and industry information. It incorporates transfer learning in diffusion models by training them in a large source domain and synthesizing data in the target domain.

Key Results

- DiffsFormer improves the performance of backbone models by 0.50% to 13.19% and 4.01% to 70.84% on return ratio for CSI300 and CSI800, respectively, demonstrating the necessity of data augmentation strategies in stock forecasting.

- DiffsFormer boosts the weighted Information Coefficient (IC) for most methods on CSI300 and improves it for more than half of the methods on CSI800, verifying its effectiveness in improving model performance.

- The proposed method alleviates the low SNR issue of financial data, as data augmentation brings the performance of backbone methods with original features back to normal.

Significance

This work addresses the challenge of data scarcity in stock forecasting tasks by proposing DiffsFormer, which enhances model performance, reduces volatility, and increases time efficiency through novel data augmentation mechanisms and transfer learning.

Technical Contribution

DiffsFormer presents a novel conditional diffusion Transformer framework for stock forecasting, incorporating transfer learning and data augmentation mechanisms to improve model performance and address data scarcity issues.

Novelty

DiffsFormer stands out by combining diffusion models with transfer learning and novel data augmentation techniques tailored specifically for stock forecasting, outperforming traditional data augmentation methods like random noise addition.

Limitations

- The study does not extensively explore the generalizability of DiffsFormer across various market conditions or geographical regions.

- Limited analysis on the impact of DiffsFormer on other financial instruments beyond stocks.

Future Work

- Investigate the applicability of DiffsFormer in other financial markets and instruments.

- Explore the integration of DiffsFormer with other machine learning and deep learning techniques for enhanced performance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Time-Series Data Augmentation Model through Diffusion and Transformer Integration

Yuren Zhang, Lei Jing, Zhongnan Pu

Hyperspectral data augmentation with transformer-based diffusion models

Lorenzo Bruzzone, Mattia Ferrari

Transformer-Based Deep Learning Model for Stock Price Prediction: A Case Study on Bangladesh Stock Market

Mohammad Shafiul Alam, Muhammad Ibrahim, Tashreef Muhammad et al.

MASTER: Market-Guided Stock Transformer for Stock Price Forecasting

Yanyan Shen, Zhaoyang Liu, Tong Li et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)