Summary

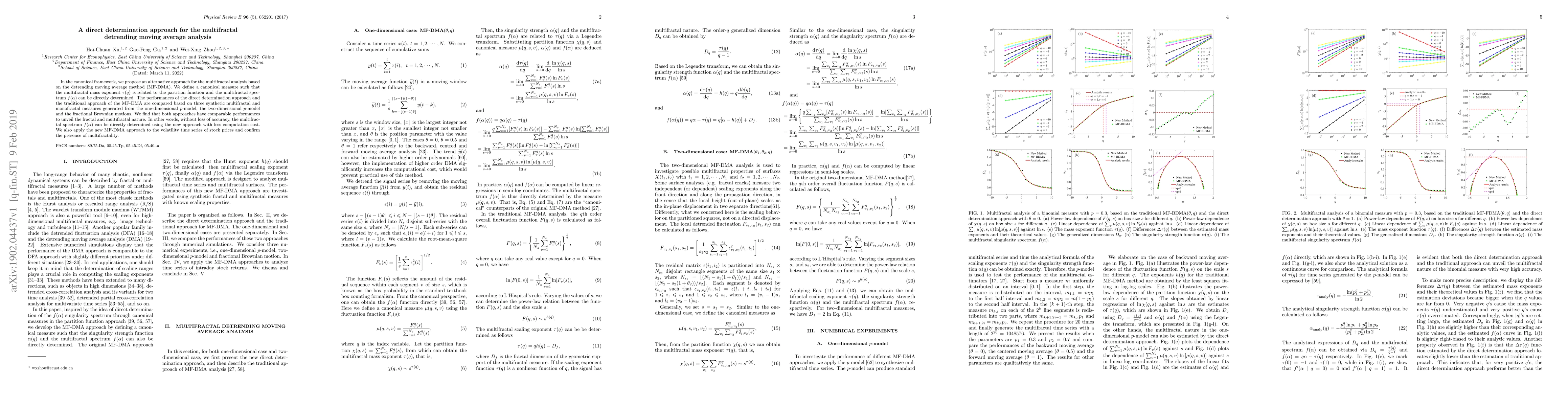

In the canonical framework, we propose an alternative approach for the multifractal analysis based on the detrending moving average method (MF-DMA). We define a canonical measure such that the multifractal mass exponent $\tau(q)$ is related to the partition function and the multifractal spectrum $f(\alpha)$ can be directly determined. The performances of the direct determination approach and the traditional approach of the MF-DMA are compared based on three synthetic multifractal and monofractal measures generated from the one-dimensional $p$-model, the two-dimensional $p$-model and the fractional Brownian motions. We find that both approaches have comparable performances to unveil the fractal and multifractal nature. In other words, without loss of accuracy, the multifractal spectrum $f(\alpha)$ can be directly determined using the new approach with less computation cost. We also apply the new MF-DMA approach to the volatility time series of stock prices and confirm the presence of multifractality.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)