Summary

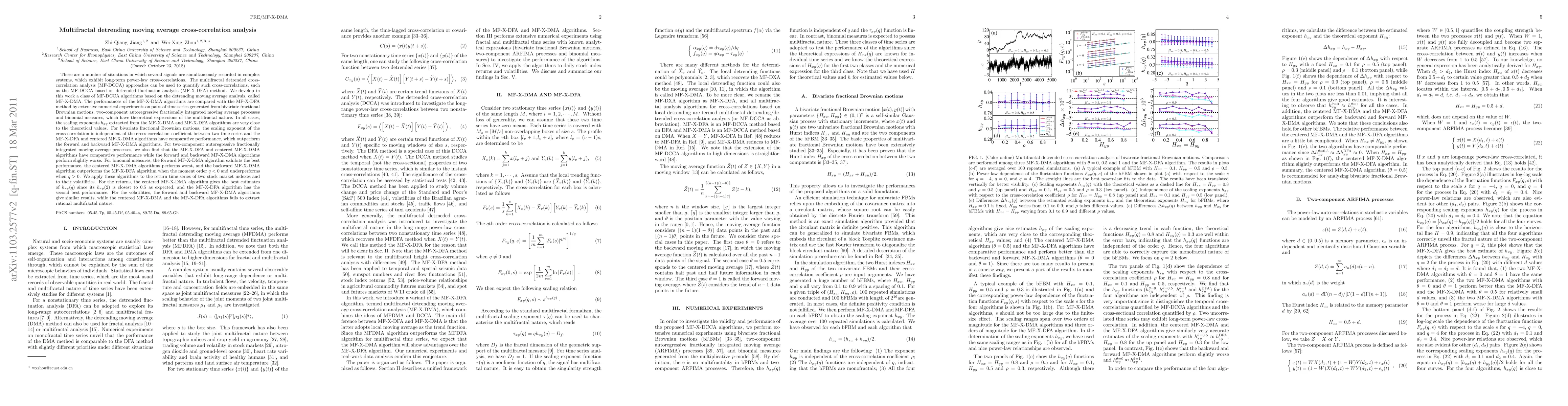

There are a number of situations in which several signals are simultaneously recorded in complex systems, which exhibit long-term power-law cross-correlations. The multifractal detrended cross-correlation analysis (MF-DCCA) approaches can be used to quantify such cross-correlations, such as the MF-DCCA based on detrended fluctuation analysis (MF-X-DFA) method. We develop in this work a class of MF-DCCA algorithms based on the detrending moving average analysis, called MF-X-DMA. The performances of the MF-X-DMA algorithms are compared with the MF-X-DFA method by extensive numerical experiments on pairs of time series generated from bivariate fractional Brownian motions, two-component autoregressive fractionally integrated moving average processes and binomial measures, which have theoretical expressions of the multifractal nature. In all cases, the scaling exponents $h_{xy}$ extracted from the MF-X-DMA and MF-X-DFA algorithms are very close to the theoretical values. For bivariate fractional Brownian motions, the scaling exponent of the cross-correlation is independent of the cross-correlation coefficient between two time series and the MF-X-DFA and centered MF-X-DMA algorithms have comparative performance, which outperform the forward and backward MF-X-DMA algorithms. We apply these algorithms to the return time series of two stock market indexes and to their volatilities. For the returns, the centered MF-X-DMA algorithm gives the best estimates of $h_{xy}(q)$ since its $h_{xy}(2)$ is closest to 0.5 as expected, and the MF-X-DFA algorithm has the second best performance. For the volatilities, the forward and backward MF-X-DMA algorithms give similar results, while the centered MF-X-DMA and the MF-X-DFA algorithms fails to extract rational multifractal nature.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)