Summary

We consider an economy composed of different risk profile regions wishing to be hedged against a disaster risk using multi-region catastrophe insurance. Such catastrophic events inherently have a systemic component; we consider situations where the insurer faces a non-zero probability of insolvency. To protect the regions against the risk of the insurer's default, we introduce a public-private partnership between the government and the insurer. When a disaster generates losses exceeding the total capital of the insurer, the central government intervenes by implementing a taxation system to share the residual claims. In this study, we propose a theoretical framework for regional participation in collective risk-sharing through tax revenues by accounting for their disaster risk profiles and their economic status.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

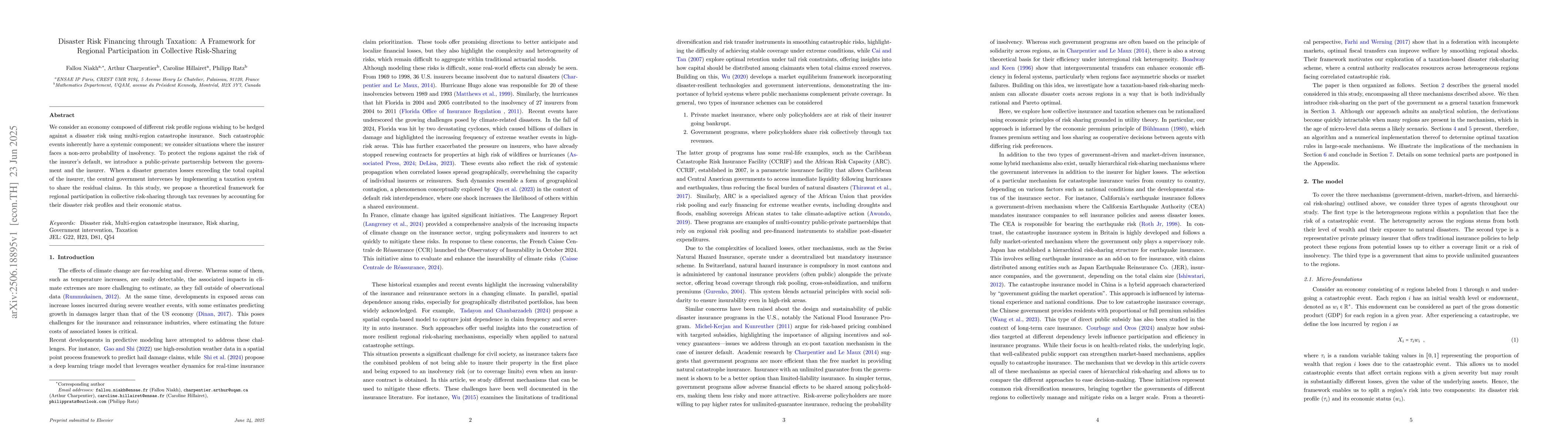

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIndividual and Collective Welfare in Risk Sharing with Many States

Federico Echenique, Farzad Pourbabaee

No citations found for this paper.

Comments (0)