Authors

Summary

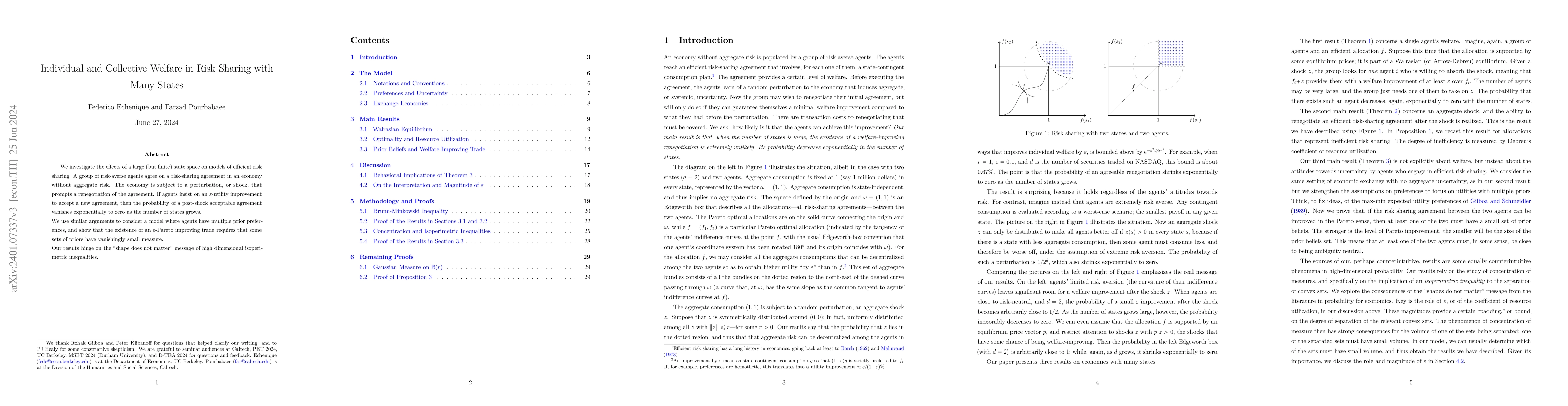

We investigate the effects of a large (but finite) state space on models of efficient risk sharing. A group of risk-averse agents agree on a risk-sharing agreement in an economy without aggregate risk. The economy is subject to a perturbation, or shock, that prompts a renegotiation of the agreement. If agents insist on an $\ep$-utility improvement to accept a new agreement, then the probability of a post-shock acceptable agreement vanishes exponentially to zero as the number of states grows. We use similar arguments to consider a model where agents have multiple prior preferences, and show that the existence of an $\ep$-Pareto improving trade requires that some sets of priors have vanishingly small measure. Our results hinge on the "shape does not matter" message of high dimensional isoperimetric inequalities.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAchieving Collective Welfare in Multi-Agent Reinforcement Learning via Suggestion Sharing

Shuangqing Wei, Yue Jin, Giovanni Montana

No citations found for this paper.

Comments (0)