Authors

Summary

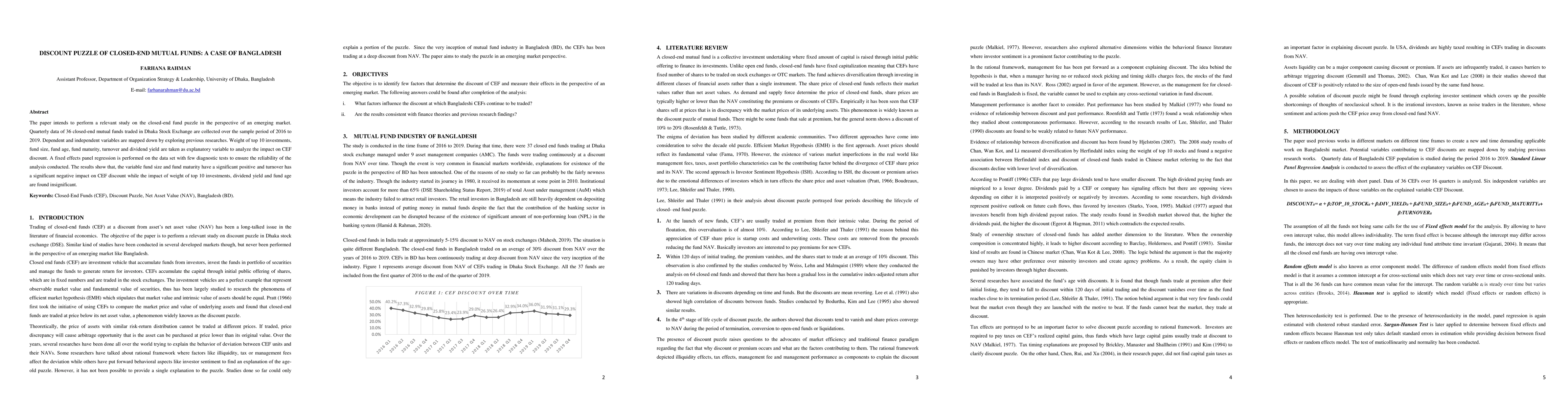

The paper intends to perform a relevant study on the closed-end fund puzzle in the perspective of an emerging market. Quarterly data of 36 closed-end mutual funds traded in Dhaka Stock Exchange are collected over the sample period of 2016 to 2019. Dependent and independent variables are mapped down by exploring previous researches. Weight of top 10 investments, fund size, fund age, fund maturity, turnover and dividend yield are taken as explanatory variable to analyze the impact on CEF discount. A fixed effects panel regression is performed on the data set with few diagnostic tests to ensure the reliability of the analysis conducted. The results show that, the variable fund size and fund maturity have a significant positive and turnover has a significant negative impact on CEF discount while the impact of weight of top 10 investments, dividend yield and fund age are found insignificant.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Case Study of Next Portfolio Prediction for Mutual Funds

Guilherme Thomaz, Denis Maua

Fund Characteristics and Performances of Socially Responsible Mutual Funds: Do ESG Ratings Play a Role?

Nandita Das, Bernadette Ruf, Swarn Chatterjee et al.

Predicting Mutual Funds' Performance using Deep Learning and Ensemble Techniques

Huy Nguyen, Nga Pham, Hien Tran et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)