Summary

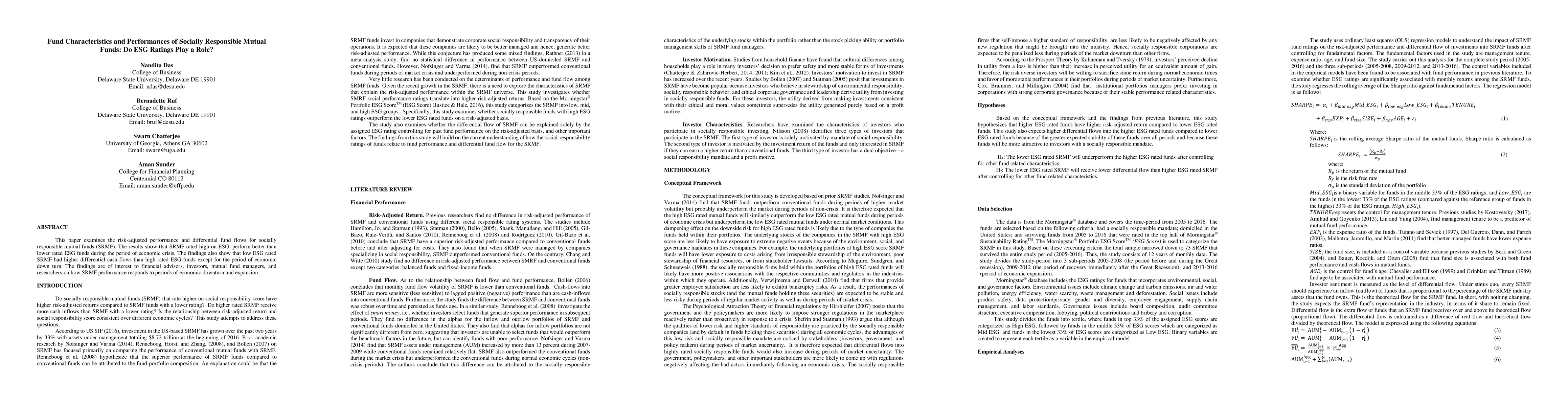

This paper examines the risk-adjusted performance and differential fund flows for socially responsible mutual funds (SRMF). The results show that SRMF rated high on ESG, perform better than lower rated ESG funds during the period of economic crisis. The findings also show that low ESG rated SRMF had higher differential cash-flows than high rated ESG funds except for the period of economic down turn. The findings are of interest to financial advisors, investors, mutual fund managers, and researchers on how SRMF performance responds to periods of economic downturn and expansion

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAn Empirical study on Mutual fund factor-risk-shifting and its intensity on Indian Equity Mutual funds

Rajesh ADJ Jeyaprakash, Senthil Arasu Balasubramanian, Vijay Maddikera

Measuring Sustainability Intention of ESG Fund Disclosure using Few-Shot Learning

Mayank Singh, Nazia Nafis, Abhijeet Kumar et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)