Summary

We discuss the asymptotic behaviour of risk-based indifference prices of European contingent claims in discrete-time financial markets under volatility uncertainty as the number of intermediate trading periods tends to infinity. The asymptotic risk-based prices form a strongly continuous convex monotone semigroup which is uniquely determined by its infinitesimal generator and therefore only depends on the covariance of the random factors but not on the particular choice of the model. We further compare the risk-based prices with the worst-case prices given by the $G$-expectation and investigate their asymptotic behaviour as the risk aversion of the agent tends to infinity. The theoretical results are illustrated with several examples and numerical simulations showing, in particular, that the risk-based prices lead to a significant reduction of the bid-ask spread compared to the worst-case prices.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

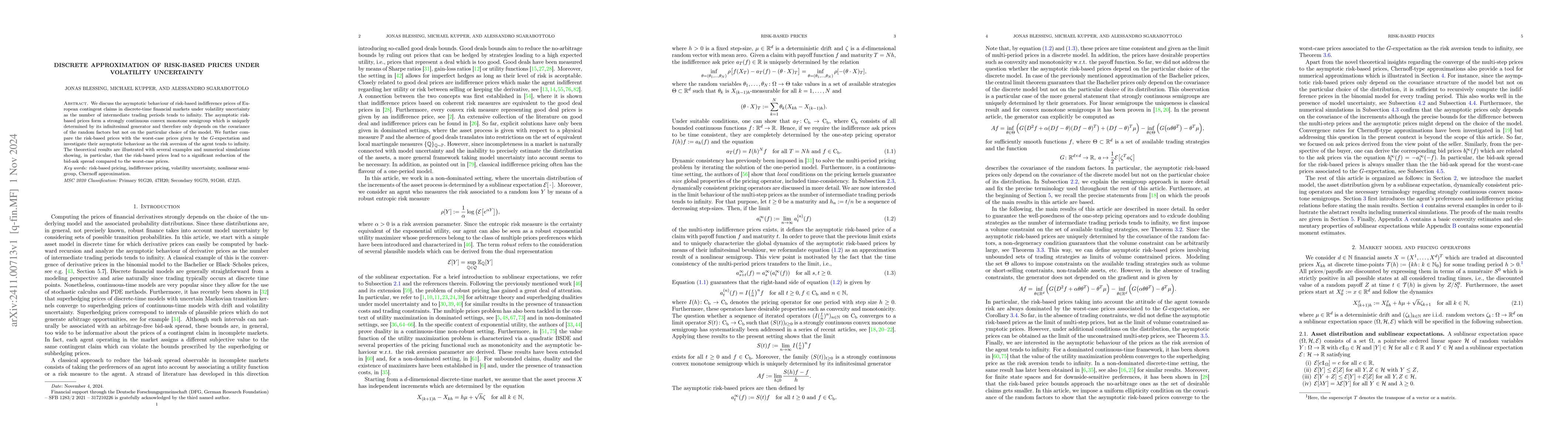

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)