Summary

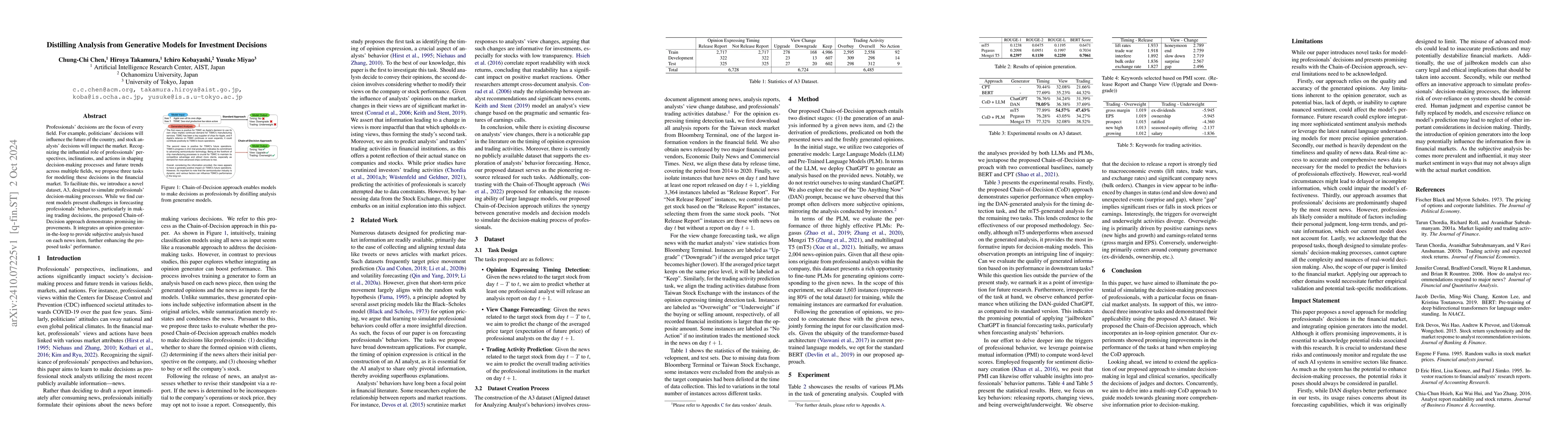

Professionals' decisions are the focus of every field. For example, politicians' decisions will influence the future of the country, and stock analysts' decisions will impact the market. Recognizing the influential role of professionals' perspectives, inclinations, and actions in shaping decision-making processes and future trends across multiple fields, we propose three tasks for modeling these decisions in the financial market. To facilitate this, we introduce a novel dataset, A3, designed to simulate professionals' decision-making processes. While we find current models present challenges in forecasting professionals' behaviors, particularly in making trading decisions, the proposed Chain-of-Decision approach demonstrates promising improvements. It integrates an opinion-generator-in-the-loop to provide subjective analysis based on each news item, further enhancing the proposed tasks' performance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPromptKD: Distilling Student-Friendly Knowledge for Generative Language Models via Prompt Tuning

Eunho Yang, Gyeongman Kim, Doohyuk Jang

Investment Decisions for Perfect and Imperfect Competition in Ireland's Electricity Market

Davoud Hosseinnezhad, Mel T. Devine, Seán McGarraghy

No citations found for this paper.

Comments (0)