Summary

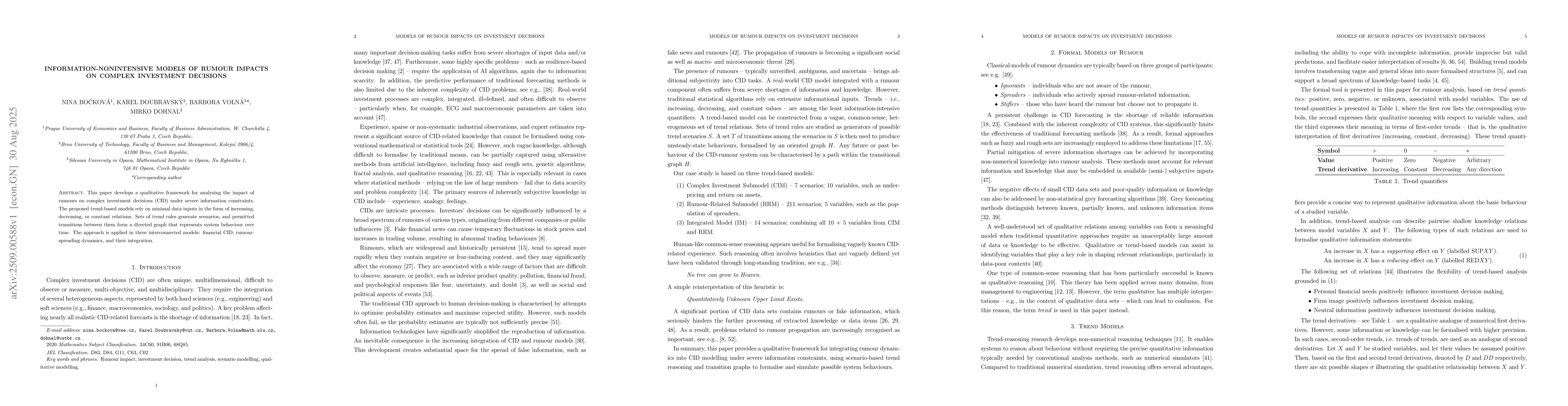

This paper develops a qualitative framework for analysing the impact of rumours on complex investment decisions (CID) under severe information constraints. The proposed trend-based models rely on minimal data inputs in the form of increasing, decreasing, or constant relations. Sets of trend rules generate scenarios, and permitted transitions between them form a directed graph that represents system behaviour over time. The approach is applied in three interconnected models: financial CID, rumour-spreading dynamics, and their integration.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersDistilling Analysis from Generative Models for Investment Decisions

Yusuke Miyao, Chung-Chi Chen, Hiroya Takamura et al.

Comments (0)