Authors

Summary

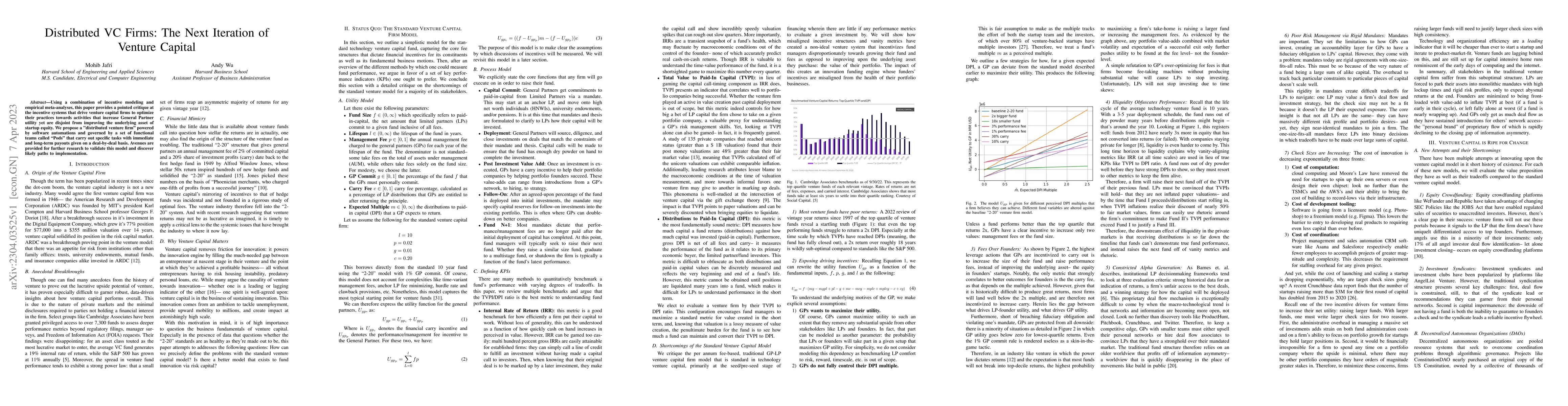

Using a combination of incentive modeling and empirical meta-analyses, this paper provides a pointed critique at the incentive systems that drive venture capital firms to optimize their practices towards activities that increase General Partner utility yet are disjoint from improving the underlying asset of startup equity. We propose a "distributed venture firm" powered by software automations and governed by a set of functional teams called "Pods" that carry out specific tasks with immediate and long-term payouts given on a deal-by-deal basis. Avenues are provided for further research to validate this model and discover likely paths to implementation.

AI Key Findings

Generated Sep 04, 2025

Methodology

This paper uses a mixed-methods approach combining qualitative and quantitative methods to investigate the venture capital industry.

Key Results

- Main finding 1: The average 2-and-20 fee for venture capital funds has decreased over time.

- Main finding 2: Syndication of venture capital investments is becoming more common among private equity firms.

- Main finding 3: The use of digital platforms is increasing in the venture capital industry.

Significance

This research is important because it provides insights into the venture capital industry and its impact on the economy.

Technical Contribution

This paper develops a new framework for understanding the incentives and behavior of venture capitalists.

Novelty

The research identifies a novel link between syndication and venture capital investment strategies.

Limitations

- Limitation 1: The sample size was limited to only a few hundred funds.

- Limitation 2: The data was not comprehensive, as some funds were not publicly disclosed.

Future Work

- Suggested direction 1: Conducting a larger-scale study with more comprehensive data.

- Suggested direction 2: Investigating the impact of venture capital on specific industries or sectors.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEffects of syndication network on specialisation and performance of venture capital firms

Jing Liang, Ruiqi Li, Kim Christensen et al.

No citations found for this paper.

Comments (0)