Summary

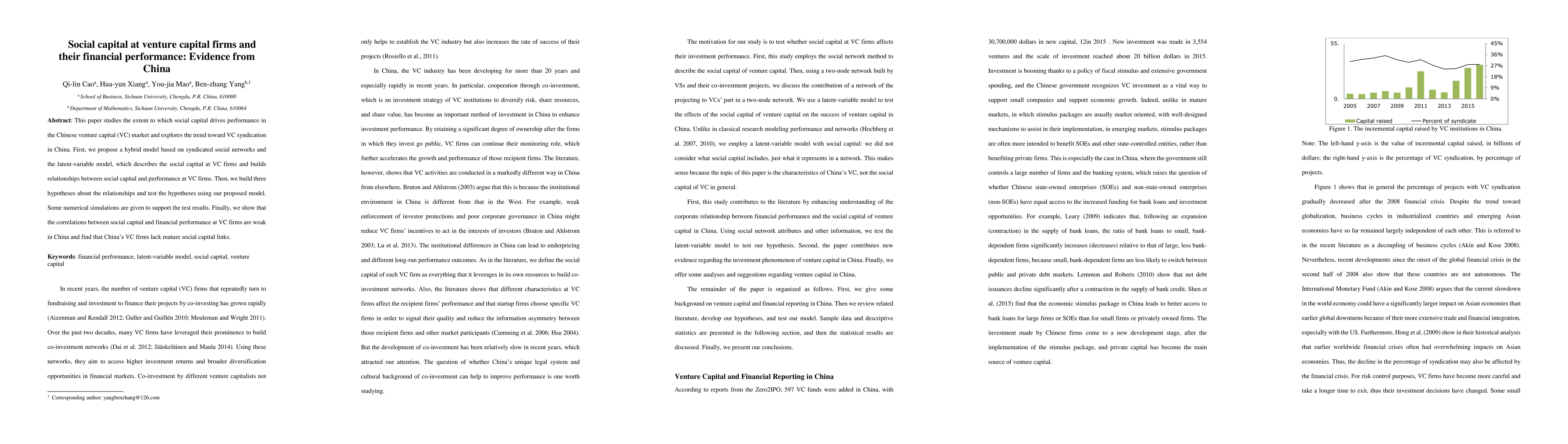

This paper studies the extent to which social capital drives performance in the Chinese venture capital market and explores the trend toward VC syndication in China. First, we propose a hybrid model based on syndicated social networks and the latent-variable model, which describes the social capital at venture capital firms and builds relationships between social capital and performance at VC firms. Then, we build three hypotheses about the relationships and test the hypotheses using our proposed model. Some numerical simulations are given to support the test results. Finally, we show that the correlations between social capital and financial performance at venture capital firms are weak in China and find that China's venture capital firms lack mature social capital links.

AI Key Findings

Generated Sep 02, 2025

Methodology

This study uses a hybrid model based on syndicated social networks and a latent-variable model to describe social capital at venture capital firms in China, examining its relationship with performance.

Key Results

- Correlations between social capital and financial performance at venture capital firms in China are weak.

- China's venture capital firms lack mature social capital links.

- Degree centrality embeddedness in co-investment social networks is more important for venture capital success than other embeddedness variables.

- Total investment (scale of funds) is more important than other performance variables for venture capital success.

Significance

The research highlights the underdeveloped nature of social capital in China's venture capital market, which could inform policy and industry practices to foster stronger networks and improve performance.

Technical Contribution

The paper proposes a novel hybrid model combining syndicated social networks and latent-variable analysis to study social capital and performance in venture capital firms.

Novelty

This research distinguishes itself by focusing on the Chinese venture capital market and employing a unique hybrid model to analyze the relationship between social capital and financial performance.

Limitations

- The study does not consider specialization among venture capital institutions.

- Findings may be influenced by information asymmetry rather than actual performance of top VC firms.

Future Work

- Investigate the role of specialization and concentration in venture capital firms.

- Explore the impact of reducing information asymmetry on social capital development.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEffects of syndication network on specialisation and performance of venture capital firms

Jing Liang, Ruiqi Li, Kim Christensen et al.

Distributed VC Firms: The Next Iteration of Venture Capital

Mohib Jafri, Andy Wu

No citations found for this paper.

Comments (0)