Authors

Summary

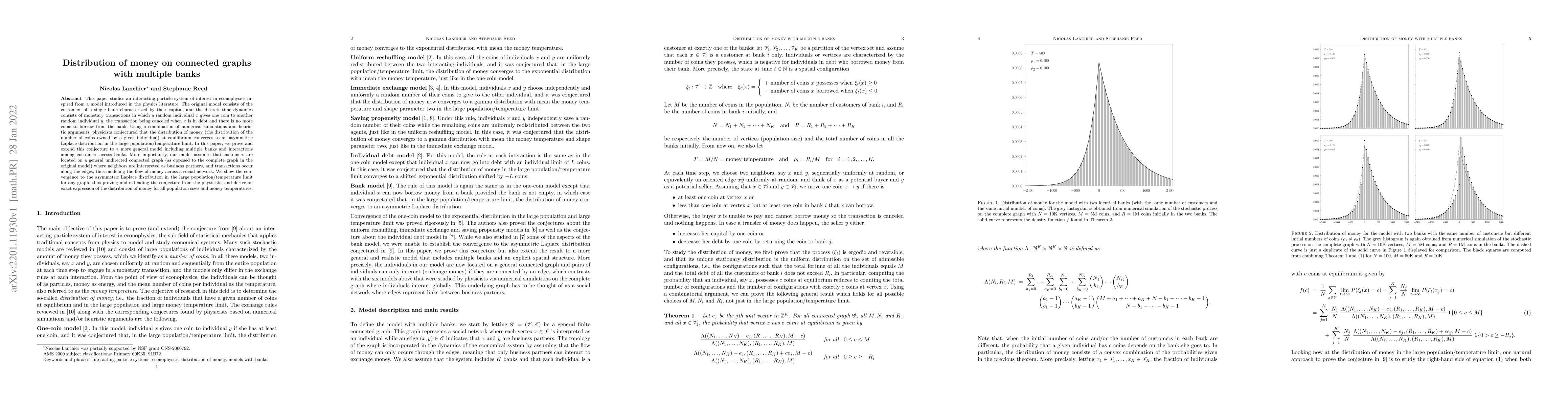

This paper studies an interacting particle system of interest in econophysics inspired from a model introduced in the physics literature. The original model consists of the customers of a single bank characterized by their capital, and the discrete-time dynamics consists of monetary transactions in which a random individual $x$ gives one coin to another random individual $y$, the transaction being canceled when $x$ is in debt and there is no more coins to borrow from the bank. Using a combination of numerical simulations and heuristic arguments, physicists conjectured that the distribution of money (the distribution of the number of coins owned by a given individual) at equilibrium converges to an asymmetric Laplace distribution in the large population/temperature limit. In this paper, we prove and extend this conjecture to a more general model including multiple banks and interactions among customers across banks. More importantly, our model assumes that customers are located on a general undirected connected graph (as opposed to the complete graph in the original model) where neighbors are interpreted as business partners, and transactions occur along the edges, thus modeling the flow of money across a social network. We show the convergence to the asymmetric Laplace distribution in the large population/temperature limit for any graph, thus proving and extending the conjecture from the physicists, and derive an exact expression of the distribution of money for all population sizes and money temperatures.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)