Summary

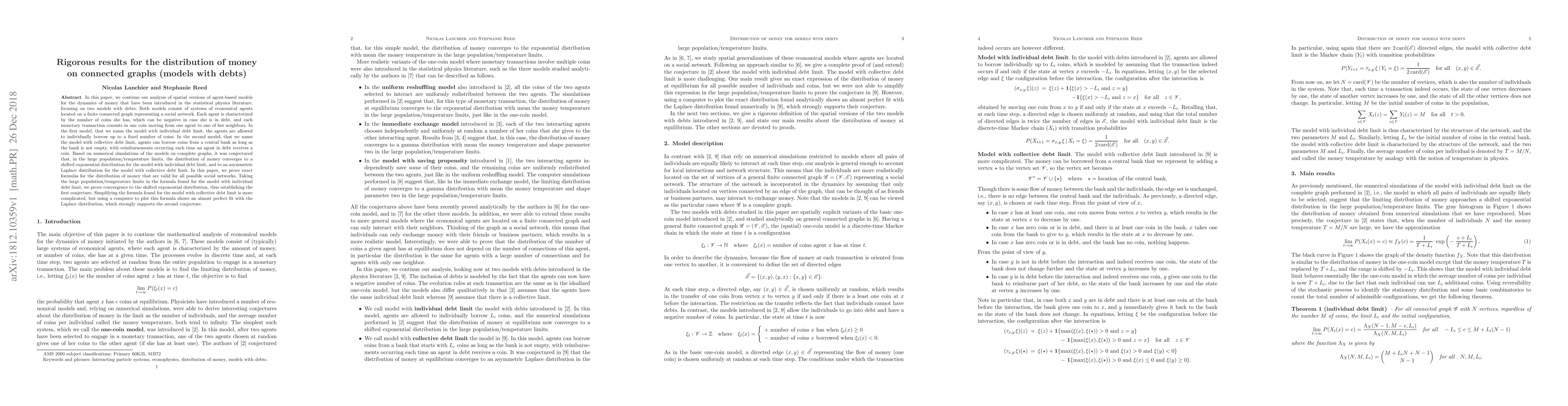

In this paper, we continue our analysis of spatial versions of agent-based models for the dynamics of money that have been introduced in the statistical physics literature, focusing on two models with debts. Both models consist of systems of economical agents located on a finite connected graph representing a social network. Each agent is characterized by the number of coins she has, which can be negative in case she is in debt, and each monetary transaction consists in one coin moving from one agent to one of her neighbors. In the first model, that we name the model with individual debt limit, the agents are allowed to individually borrow up to a fixed number of coins. In the second model, that we name the model with collective debt limit, agents can borrow coins from a central bank as long as the bank is not empty, with reimbursements occurring each time an agent in debt receives a coin. Based on numerical simulations of the models on complete graphs, it was conjectured that, in the large population/temperature limits, the distribution of money converges to a shifted exponential distribution for the model with individual debt limit, and to an asymmetric Laplace distribution for the model with collective debt limit. In this paper, we prove exact formulas for the distribution of money that are valid for all possible social networks. Taking the large population/temperature limits in the formula found for the model with individual debt limit, we prove convergence to the shifted exponential distribution, thus establishing the first conjecture. Simplifying the formula found for the model with collective debt limit is more complicated, but using a computer to plot this formula shows an almost perfect fit with the Laplace distribution, which strongly supports the second conjecture.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)