Summary

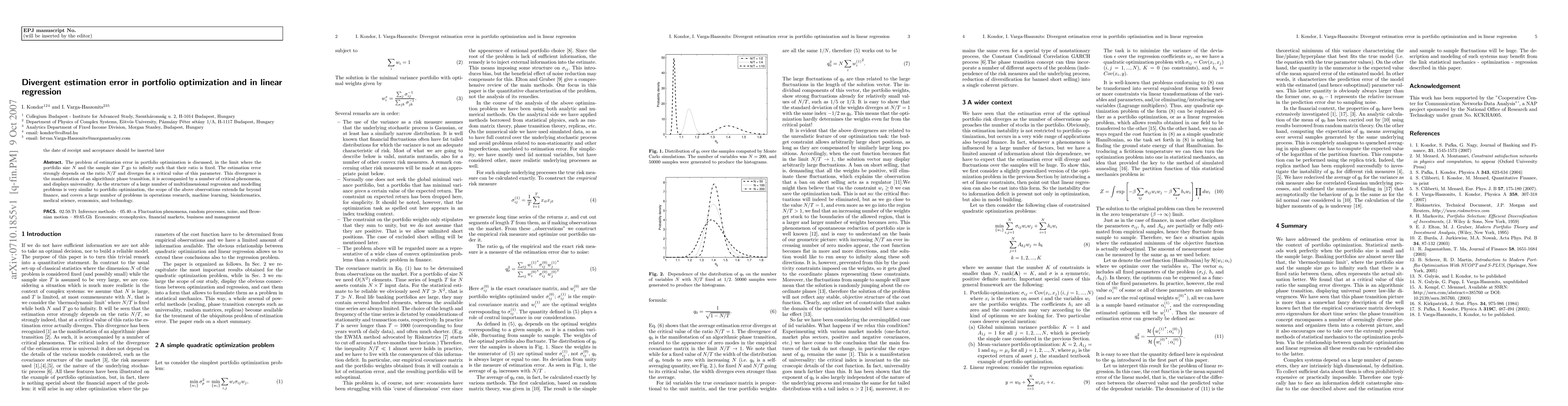

The problem of estimation error in portfolio optimization is discussed, in the limit where the portfolio size N and the sample size T go to infinity such that their ratio is fixed. The estimation error strongly depends on the ratio N/T and diverges for a critical value of this parameter. This divergence is the manifestation of an algorithmic phase transition, it is accompanied by a number of critical phenomena, and displays universality. As the structure of a large number of multidimensional regression and modelling problems is very similar to portfolio optimization, the scope of the above observations extends far beyond finance, and covers a large number of problems in operations research, machine learning, bioinformatics, medical science, economics, and technology.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)