Summary

We test the hypothesis that interconnections across financial institutions can be explained by a diversification motive. This idea stems from the empirical evidence of the existence of long-term exposures that cannot be explained by a liquidity motive (maturity or currency mismatch). We model endogenous interconnections of heterogenous financial institutions facing regulatory constraints using a maximization of their expected utility. Both theoretical and simulation-based results are compared to a stylized genuine financial network. The diversification motive appears to plausibly explain interconnections among key players. Using our model, the impact of regulation on interconnections between banks -currently discussed at the Basel Committee on Banking Supervision- is analyzed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

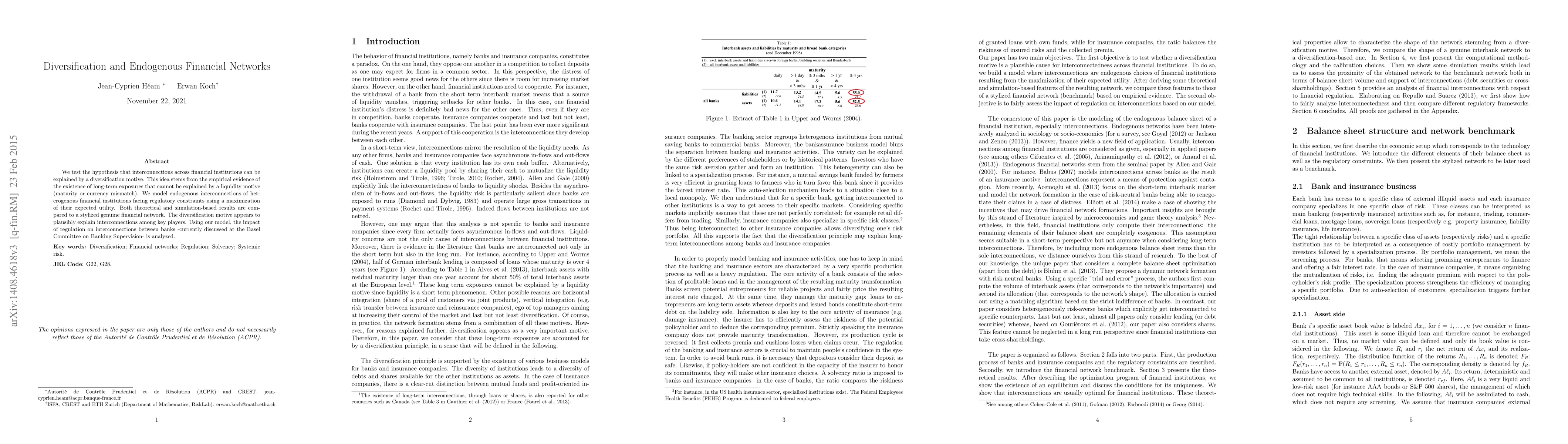

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFinancial instability transition under heterogeneous investments and portfolio diversification

Silvia Bartolucci, Sabrina Aufiero, Preben Forer et al.

On financial market correlation structures and diversification benefits across and within equity sectors

Georg A. Gottwald, Nick James, Max Menzies

No citations found for this paper.

Comments (0)