Summary

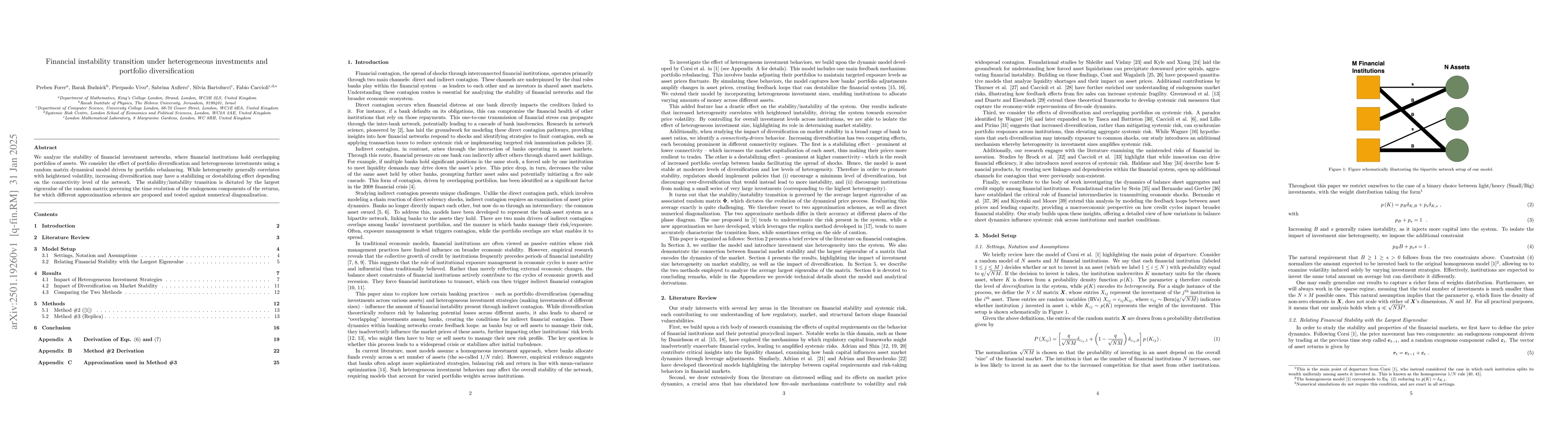

We analyze the stability of financial investment networks, where financial institutions hold overlapping portfolios of assets. We consider the effect of portfolio diversification and heterogeneous investments using a random matrix dynamical model driven by portfolio rebalancing. While heterogeneity generally correlates with heightened volatility, increasing diversification may have a stabilizing or destabilizing effect depending on the connectivity level of the network. The stability/instability transition is dictated by the largest eigenvalue of the random matrix governing the time evolution of the endogenous components of the returns, for which different approximation schemes are proposed and tested against numerical diagonalization.

AI Key Findings

Generated Jun 12, 2025

Methodology

The research employs a random matrix dynamical model driven by portfolio rebalancing to analyze financial investment networks, focusing on the effects of heterogeneous investments and portfolio diversification.

Key Results

- Heterogeneous investments generally correlate with increased volatility in financial networks.

- Portfolio diversification can have a stabilizing or destabilizing effect depending on the network's connectivity level.

- The stability/instability transition is determined by the largest eigenvalue of the random matrix governing the time evolution of the endogenous components of returns.

Significance

This research is important as it provides insights into the dynamics of financial instability transitions, which can inform regulatory policies and risk management strategies for financial institutions.

Technical Contribution

The paper proposes and tests different approximation schemes for calculating the largest eigenvalue of the random matrix, which is crucial for understanding the stability/instability transition in financial networks.

Novelty

This work distinguishes itself by integrating random matrix theory with portfolio rebalancing to analyze financial network stability, offering new perspectives on the role of diversification and heterogeneous investments.

Limitations

- The study assumes a simplified model of financial networks and rebalancing processes.

- Real-world financial systems are more complex and may not fully conform to the model's assumptions.

Future Work

- Investigate the impact of behavioral factors and non-rational investor decisions on financial network stability.

- Explore the implications of the findings for designing more resilient financial systems.

Paper Details

PDF Preview

Similar Papers

Found 4 papersThe lexical ratio: A new perspective on portfolio diversification

Sayyed Faraz Mohseni, Hamid R. Arian, Jean-François Bégin

Bayesian Optimization of ESG Financial Investments

Eduardo C. Garrido-Merchán, Gabriel González Piris, Maria Coronado Vaca

No citations found for this paper.

Comments (0)