Summary

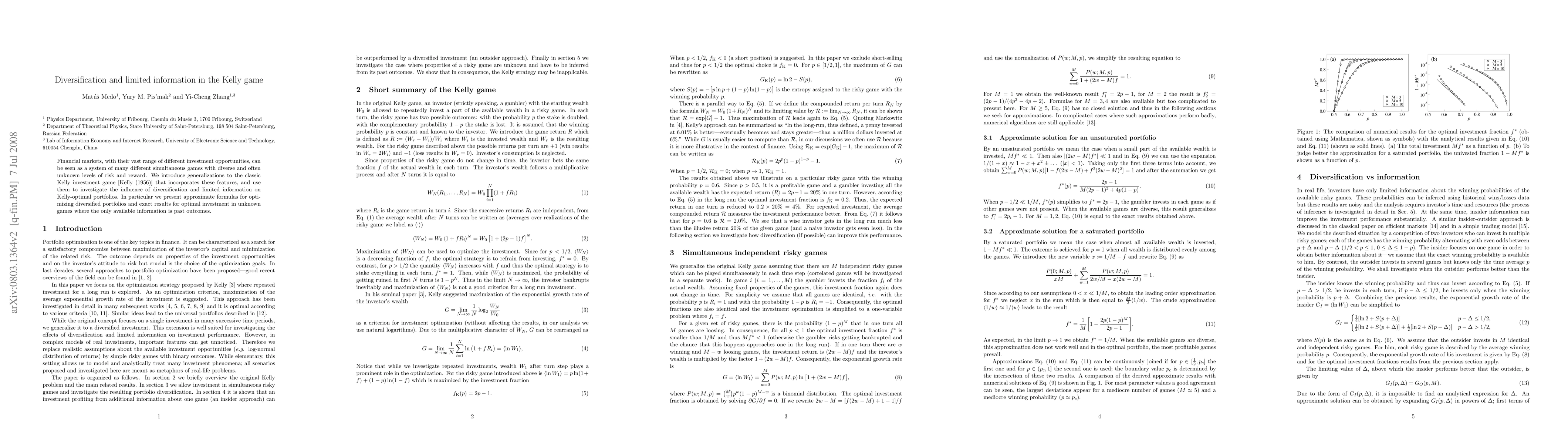

Financial markets, with their vast range of different investment opportunities, can be seen as a system of many different simultaneous games with diverse and often unknown levels of risk and reward. We introduce generalizations to the classic Kelly investment game [Kelly (1956)] that incorporates these features, and use them to investigate the influence of diversification and limited information on Kelly-optimal portfolios. In particular we present approximate formulas for optimizing diversified portfolios and exact results for optimal investment in unknown games where the only available information is past outcomes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA quantum double-or-nothing game: The Kelly Criterion for Spins

Bernhard K Meister, Henry C W Price

Limited Information Shared Control: A Potential Game Approach

Soeren Hohmann, Balint Varga, Jairo Inga

| Title | Authors | Year | Actions |

|---|

Comments (0)