Authors

Summary

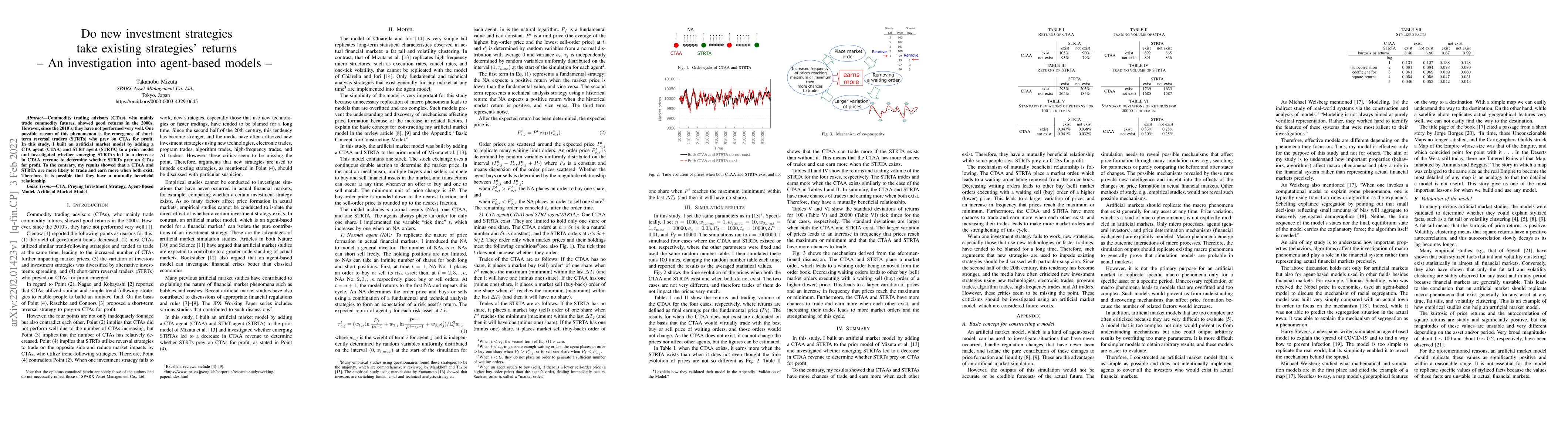

Commodity trading advisors (CTAs), who mainly trade commodity futures, showed good returns in the 2000s. However, since the 2010's, they have not performed very well. One possible reason of this phenomenon is the emergence of short-term reversal traders (STRTs) who prey on CTAs for profit. In this study, I built an artificial market model by adding a CTA agent (CTAA) and STRT agent (STRTA) to a prior model and investigated whether emerging STRTAs led to a decrease in CTAA revenue to determine whether STRTs prey on CTAs for profit. To the contrary, my results showed that a CTAA and STRTA are more likely to trade and earn more when both exist. Therefore, it is possible that they have a mutually beneficial relationship.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)