Summary

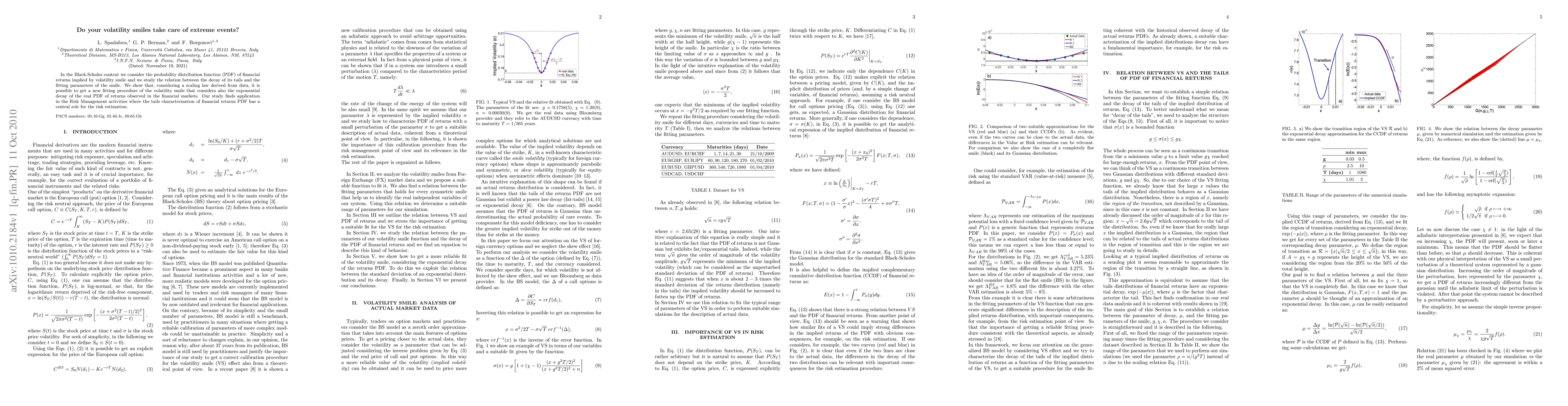

In the Black-Scholes context we consider the probability distribution function (PDF) of financial returns implied by volatility smile and we study the relation between the decay of its tails and the fitting parameters of the smile. We show that, considering a scaling law derived from data, it is possible to get a new fitting procedure of the volatility smile that considers also the exponential decay of the real PDF of returns observed in the financial markets. Our study finds application in the Risk Management activities where the tails characterization of financial returns PDF has a central role for the risk estimation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNew volatility evolution model after extreme events

Wei Zhang, Fei Ren, Xiong Xiong et al.

The quintic Ornstein-Uhlenbeck volatility model that jointly calibrates SPX & VIX smiles

Li, Eduardo Abi Jaber, Shaun et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)