Summary

The paper studies estimation of parameters of diffusion market models from historical data. The standard definition of implied volatility for these models presents its value as an implicit function of several parameters, including the risk-free interest rate. In reality, the risk free interest rate is unknown and need to be forecasted, because the option price depends on its future curve. Therefore, the standard implied volatility is {\it conditional}: it depends on the future values of the risk free rate. We study two implied parameters: the implied volatility and the implied average cumulative risk free interest rate. They can be found unconditionally from a system of two equations. We found that very simple models with random volatilities (for instance, with two point distributions) generate various volatility smiles and skews with this approach.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

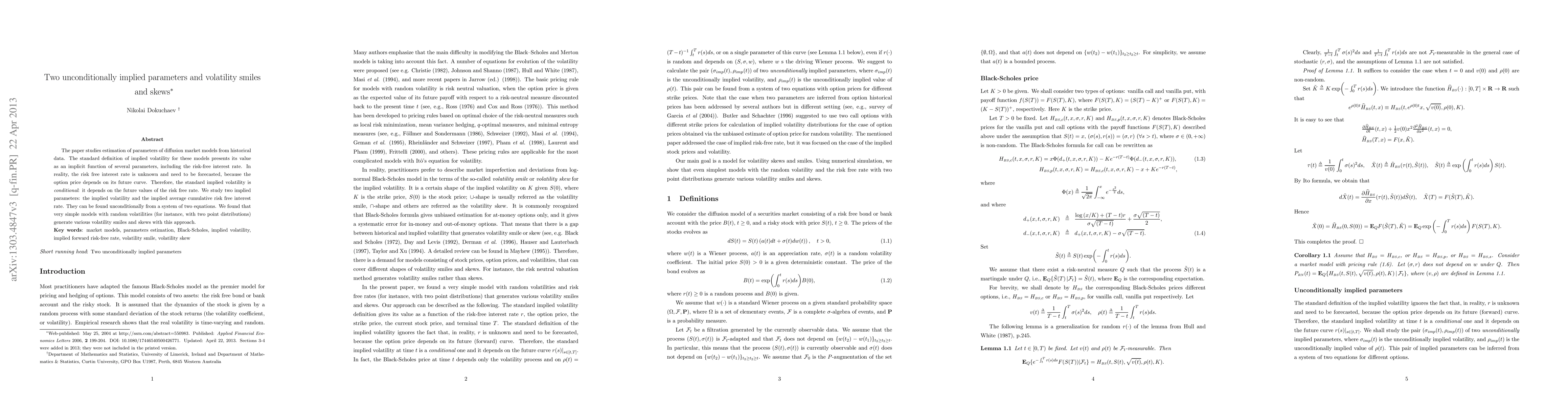

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe ATM implied volatility slope, the (dual) volatility swap, and the (dual) zero vanna implied volatility

Frido Rolloos

Implied volatility (also) is path-dependent

Hervé Andrès, Alexandre Boumezoued, Benjamin Jourdain

Correct implied volatility shapes and reliable pricing in the rough Heston model

Svetlana Boyarchenko, Sergei Levendorskiǐ

| Title | Authors | Year | Actions |

|---|

Comments (0)