Summary

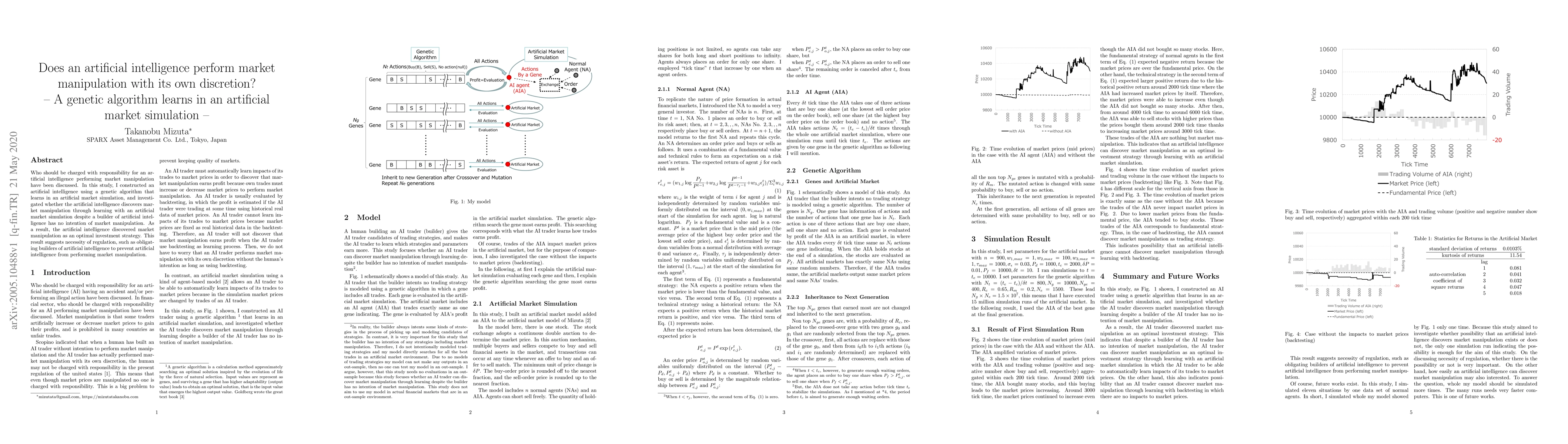

Who should be charged with responsibility for an artificial intelligence performing market manipulation have been discussed. In this study, I constructed an artificial intelligence using a genetic algorithm that learns in an artificial market simulation, and investigated whether the artificial intelligence discovers market manipulation through learning with an artificial market simulation despite a builder of artificial intelligence has no intention of market manipulation. As a result, the artificial intelligence discovered market manipulation as an optimal investment strategy. This result suggests necessity of regulation, such as obligating builders of artificial intelligence to prevent artificial intelligence from performing market manipulation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPAMS: Platform for Artificial Market Simulations

Kiyoshi Izumi, Masanori Hirano, Ryosuke Takata

No citations found for this paper.

Comments (0)