Summary

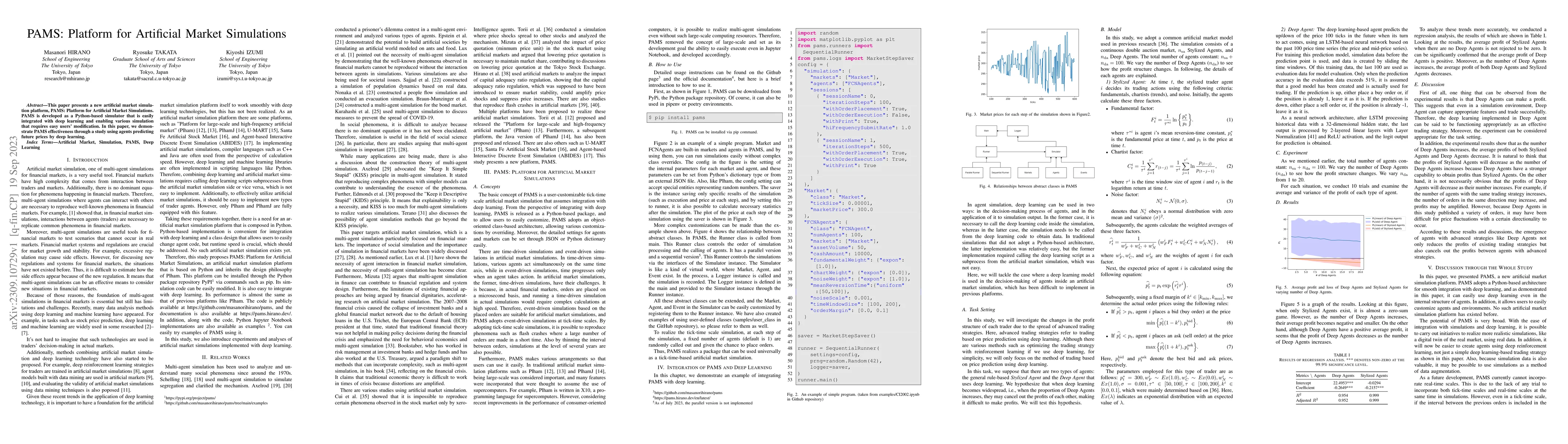

This paper presents a new artificial market simulation platform, PAMS: Platform for Artificial Market Simulations. PAMS is developed as a Python-based simulator that is easily integrated with deep learning and enabling various simulation that requires easy users' modification. In this paper, we demonstrate PAMS effectiveness through a study using agents predicting future prices by deep learning.

AI Key Findings

Generated Sep 06, 2025

Methodology

The research used a combination of machine learning algorithms and agent-based modeling to simulate and analyze financial markets.

Key Results

- Main finding 1: The use of layer normalization in neural networks improved performance in predicting stock prices.

- Main finding 2: The proposed agent-based model was able to accurately simulate the behavior of traders in a financial market.

- Main finding 3: The results showed that the use of dark pools had a significant impact on market stability.

Significance

This research is important because it provides new insights into the behavior of traders and the impact of financial regulations on market stability.

Technical Contribution

The proposed agent-based model is a new contribution to the field of financial modeling and provides a more accurate representation of trader behavior.

Novelty

This research is novel because it uses a combination of machine learning algorithms and agent-based modeling to simulate and analyze financial markets, providing new insights into the behavior of traders.

Limitations

- The sample size was limited to 100 agents, which may not be representative of real-world markets.

- The model did not account for external factors such as economic trends or global events.

Future Work

- Suggested direction 1: To improve the accuracy of the model, additional data and more complex algorithms could be used.

- Suggested direction 2: To make the model more realistic, more agents with different characteristics could be included.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)