Authors

Summary

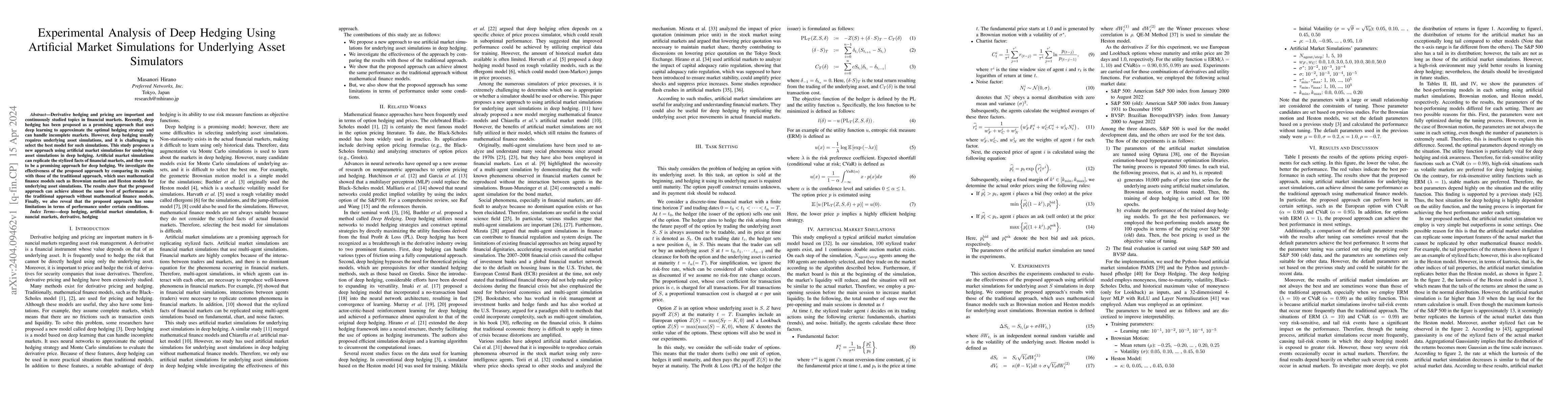

Derivative hedging and pricing are important and continuously studied topics in financial markets. Recently, deep hedging has been proposed as a promising approach that uses deep learning to approximate the optimal hedging strategy and can handle incomplete markets. However, deep hedging usually requires underlying asset simulations, and it is challenging to select the best model for such simulations. This study proposes a new approach using artificial market simulations for underlying asset simulations in deep hedging. Artificial market simulations can replicate the stylized facts of financial markets, and they seem to be a promising approach for deep hedging. We investigate the effectiveness of the proposed approach by comparing its results with those of the traditional approach, which uses mathematical finance models such as Brownian motion and Heston models for underlying asset simulations. The results show that the proposed approach can achieve almost the same level of performance as the traditional approach without mathematical finance models. Finally, we also reveal that the proposed approach has some limitations in terms of performance under certain conditions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInflexible Multi-Asset Hedging of incomplete market

Ruochen Xiao, Qiaochu Feng, Ruxin Deng

Deep Hedging with Market Impact

Frédéric Godin, Leila Kosseim, Andrei Neagu et al.

No citations found for this paper.

Comments (0)