Authors

Summary

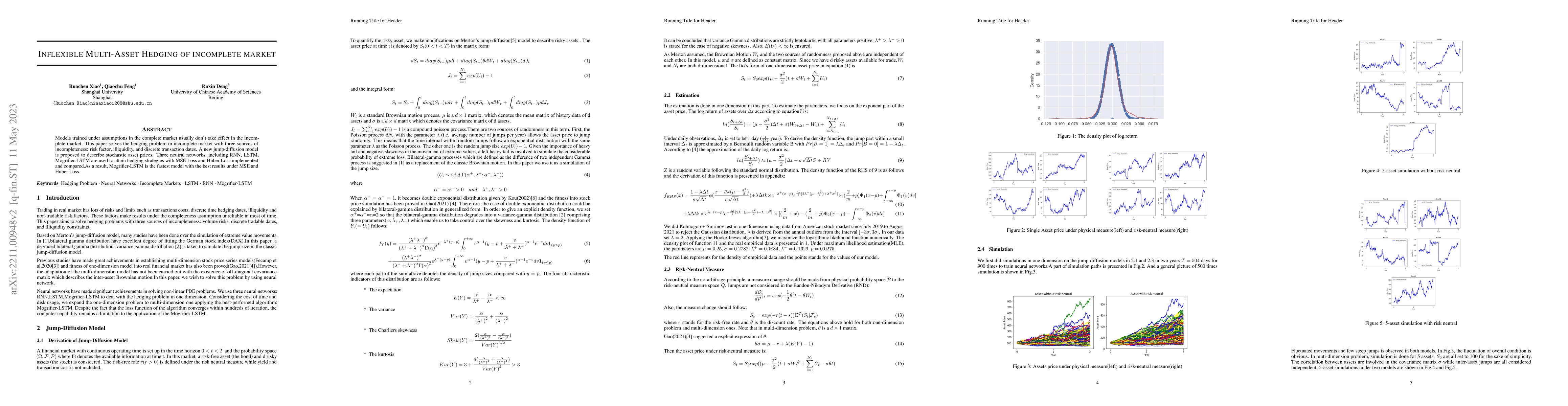

Models trained under assumptions in the complete market usually don't take effect in the incomplete market. This paper solves the hedging problem in incomplete market with three sources of incompleteness: risk factor, illiquidity, and discrete transaction dates. A new jump-diffusion model is proposed to describe stochastic asset prices. Three neutral networks, including RNN, LSTM, Mogrifier-LSTM are used to attain hedging strategies with MSE Loss and Huber Loss implemented and compared.As a result, Mogrifier-LSTM is the fastest model with the best results under MSE and Huber Loss.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMinimum Cost Super-Hedging in a Discrete Time Incomplete Multi-Asset Binomial Market

Jarek Kędra, Assaf Libman, Victoria Steblovskaya

Experimental Analysis of Deep Hedging Using Artificial Market Simulations for Underlying Asset Simulators

Masanori Hirano

Deep learning for quadratic hedging in incomplete jump market

Nacira Agram, Bernt Øksendal, Jan Rems

Pricing multi-asset contingent claims in a multi-dimensional binomial market

Jarek Kędra, Assaf Libman, Victoria Steblovskaya

No citations found for this paper.

Comments (0)