Masanori Hirano

17 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

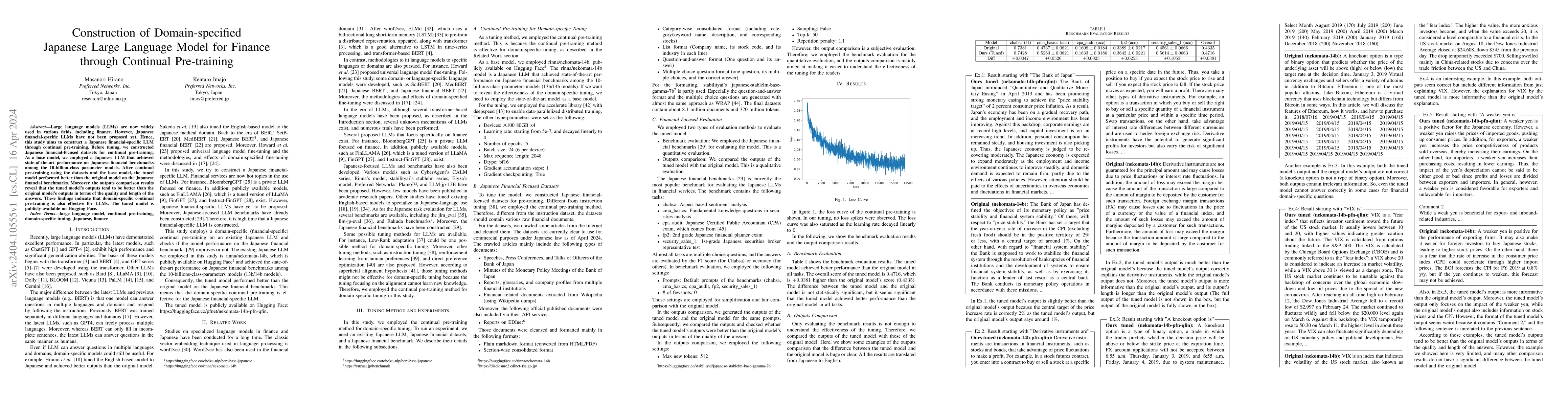

Construction of Domain-specified Japanese Large Language Model for Finance through Continual Pre-training

Large language models (LLMs) are now widely used in various fields, including finance. However, Japanese financial-specific LLMs have not been proposed yet. Hence, this study aims to construct a Jap...

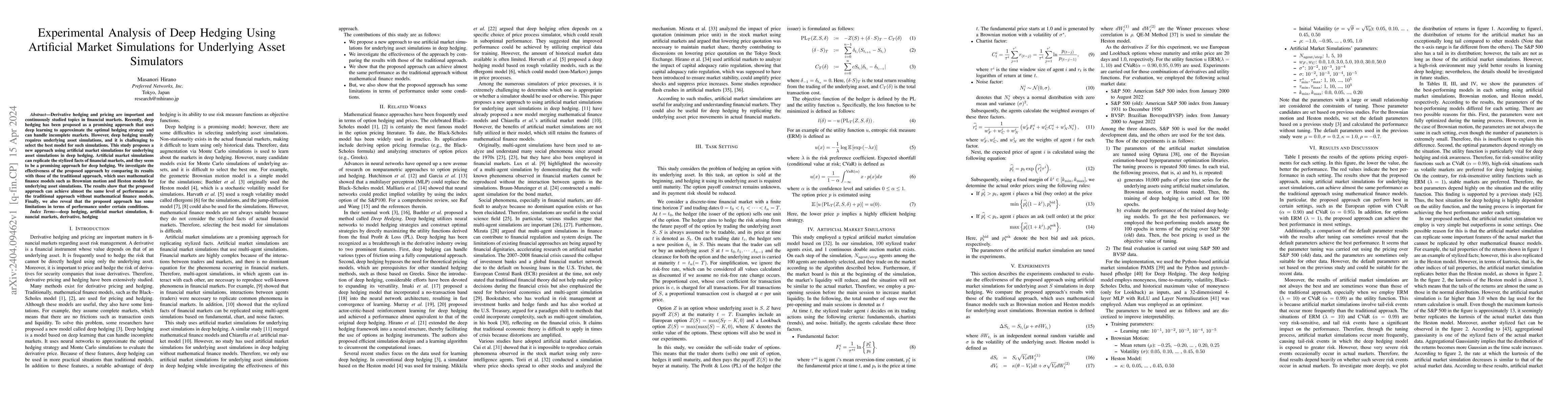

Experimental Analysis of Deep Hedging Using Artificial Market Simulations for Underlying Asset Simulators

Derivative hedging and pricing are important and continuously studied topics in financial markets. Recently, deep hedging has been proposed as a promising approach that uses deep learning to approxi...

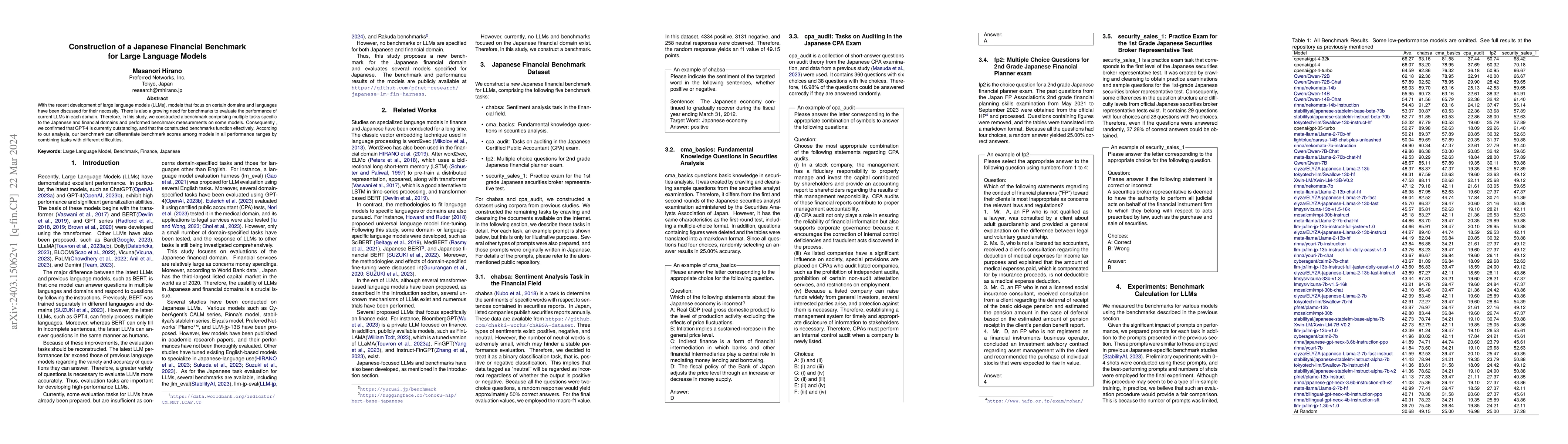

Construction of a Japanese Financial Benchmark for Large Language Models

With the recent development of large language models (LLMs), models that focus on certain domains and languages have been discussed for their necessity. There is also a growing need for benchmarks t...

Error Analysis of Option Pricing via Deep PDE Solvers: Empirical Study

Option pricing, a fundamental problem in finance, often requires solving non-linear partial differential equations (PDEs). When dealing with multi-asset options, such as rainbow options, these PDEs ...

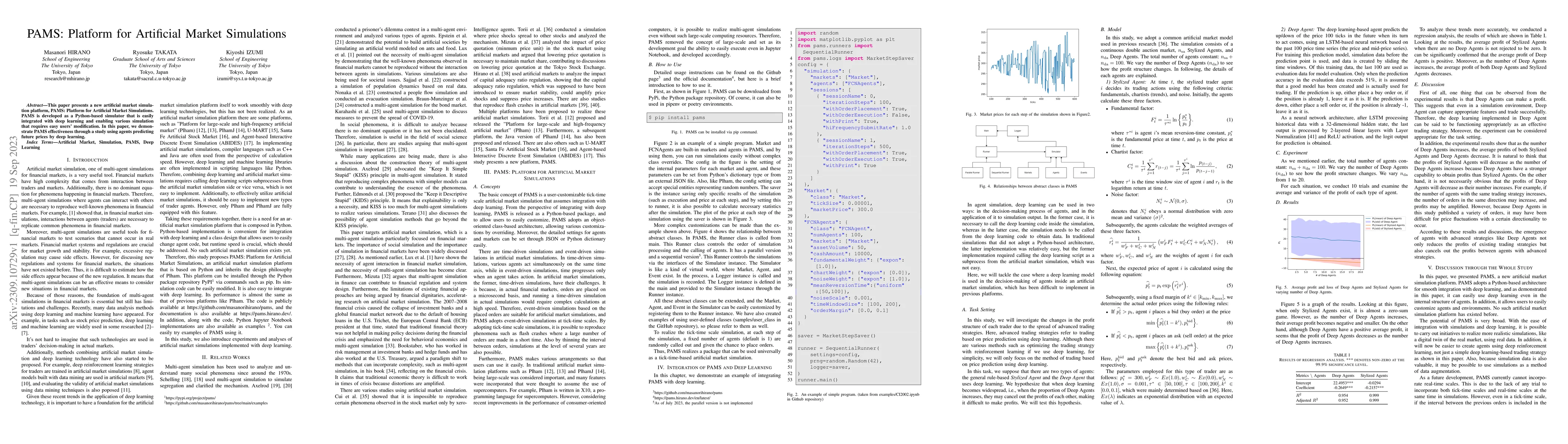

PAMS: Platform for Artificial Market Simulations

This paper presents a new artificial market simulation platform, PAMS: Platform for Artificial Market Simulations. PAMS is developed as a Python-based simulator that is easily integrated with deep l...

From Base to Conversational: Japanese Instruction Dataset and Tuning Large Language Models

Instruction tuning is essential for large language models (LLMs) to become interactive. While many instruction tuning datasets exist in English, there is a noticeable lack in other languages. Also, ...

Adversarial Deep Hedging: Learning to Hedge without Price Process Modeling

Deep hedging is a deep-learning-based framework for derivative hedging in incomplete markets. The advantage of deep hedging lies in its ability to handle various realistic market conditions, such as...

llm-japanese-dataset v0: Construction of Japanese Chat Dataset for Large Language Models and its Methodology

This study constructed a Japanese chat dataset for tuning large language models (LLMs), which consist of about 8.4 million records. Recently, LLMs have been developed and gaining popularity. However...

Efficient Learning of Nested Deep Hedging using Multiple Options

Deep hedging is a framework for hedging derivatives in the presence of market frictions. In this study, we focus on the problem of hedging a given target option by using multiple options. To extend ...

Policy Gradient Stock GAN for Realistic Discrete Order Data Generation in Financial Markets

This study proposes a new generative adversarial network (GAN) for generating realistic orders in financial markets. In some previous works, GANs for financial markets generated fake orders in conti...

A Multi-agent Market Model Can Explain the Impact of AI Traders in Financial Markets -- A New Microfoundations of GARCH model

The AI traders in financial markets have sparked significant interest in their effects on price formation mechanisms and market volatility, raising important questions for market stability and regulat...

The Construction of Instruction-tuned LLMs for Finance without Instruction Data Using Continual Pretraining and Model Merging

This paper proposes a novel method for constructing instruction-tuned large language models (LLMs) for finance without instruction data. Traditionally, developing such domain-specific LLMs has been re...

Enhancing Financial Domain Adaptation of Language Models via Model Augmentation

The domain adaptation of language models, including large language models (LLMs), has become increasingly important as the use of such models continues to expand. This study demonstrates the effective...

KANOP: A Data-Efficient Option Pricing Model using Kolmogorov-Arnold Networks

Inspired by the recently proposed Kolmogorov-Arnold Networks (KANs), we introduce the KAN-based Option Pricing (KANOP) model to value American-style options, building on the conventional Least Square ...

Evaluating Company-specific Biases in Financial Sentiment Analysis using Large Language Models

This study aims to evaluate the sentiment of financial texts using large language models~(LLMs) and to empirically determine whether LLMs exhibit company-specific biases in sentiment analysis. Specifi...

Financial Fine-tuning a Large Time Series Model

Large models have shown unprecedented capabilities in natural language processing, image generation, and most recently, time series forecasting. This leads us to ask the question: treating market pric...

A Judge-free LLM Open-ended Generation Benchmark Based on the Distributional Hypothesis

Evaluating the open-ended text generation of large language models (LLMs) is challenging because of the lack of a clear ground truth and the high cost of human or LLM-based assessments. We propose a n...