Authors

Summary

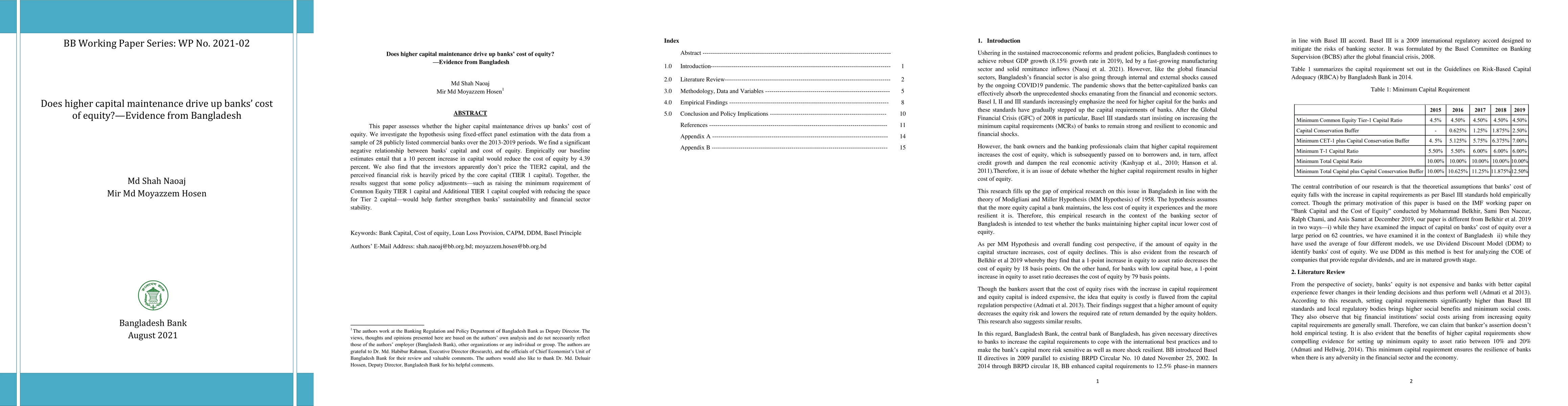

This paper assesses whether the higher capital maintenance drives up banks cost of equity. We investigate the hypothesis using fixed effect panel estimation with the data from a sample of 28 publicly listed commercial banks over the 2013 to 2019 periods. We find a significant negative relationship between banks capital and cost of equity. Empirically our baseline estimates entail that a 10 percent increase in capital would reduce the cost of equity by 4.39 percent.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersForeign Capital and Economic Growth: Evidence from Bangladesh

Ummya Salma, Md. Fazlul Huq Khan, Md. Masum Billah

Cost of Implementation of Basel III reforms in Bangladesh -- A Panel data analysis

Dipti Rani Hazra, Md. Shah Naoaj, Mohammed Mahinur Alam et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)