Authors

Summary

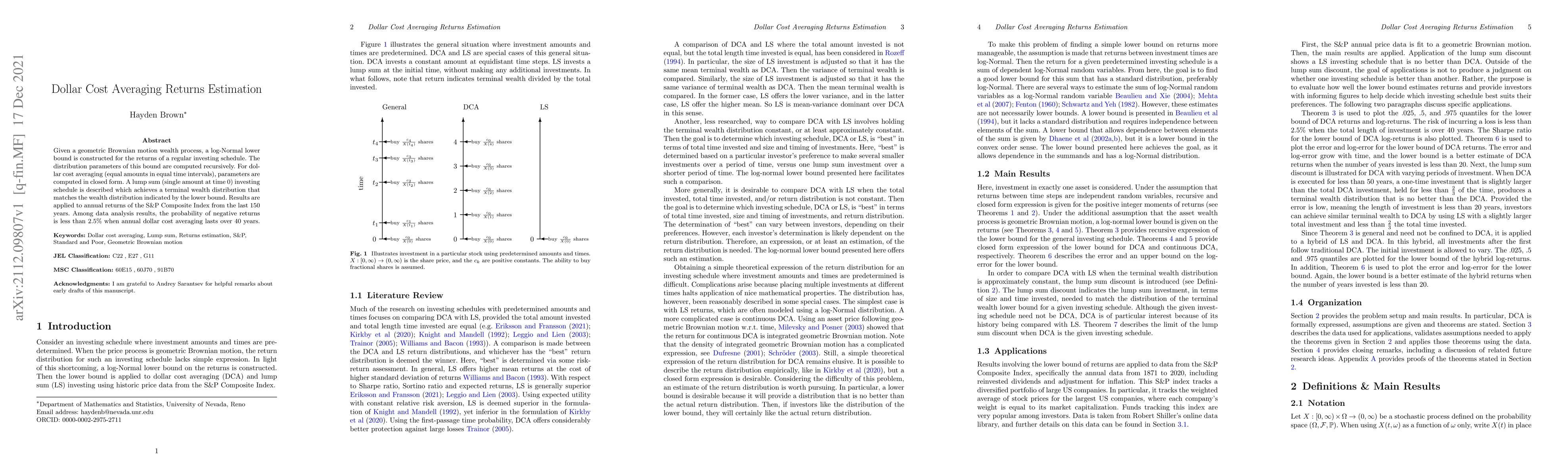

Given a geometric Brownian motion wealth process, a log-Normal lower bound is constructed for the returns of a regular investing schedule. The distribution parameters of this bound are computed recursively. For dollar cost averaging (equal amounts in equal time intervals), parameters are computed in closed form. A lump sum (single amount at time 0) investing schedule is described which achieves a terminal wealth distribution that matches the wealth distribution indicated by the lower bound. Results are applied to annual returns of the S&P Composite Index from the last 150 years. Among data analysis results, the probability of negative returns is less than 2.5% when annual dollar cost averaging lasts over 40 years.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAveraging $n$-step Returns Reduces Variance in Reinforcement Learning

Martha White, Brett Daley, Marlos C. Machado

| Title | Authors | Year | Actions |

|---|

Comments (0)