Summary

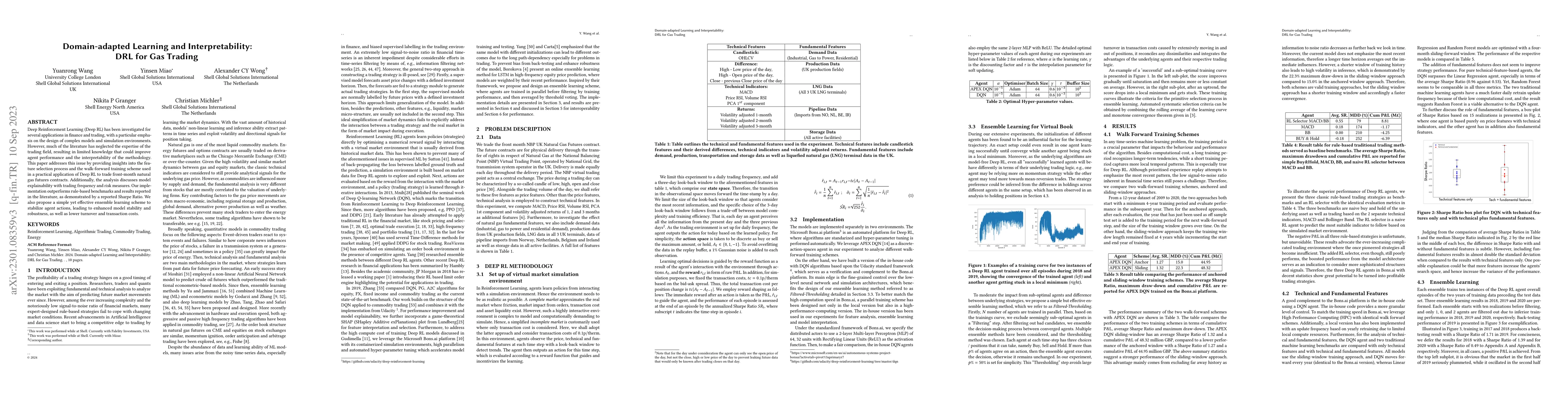

Deep Reinforcement Learning (Deep RL) has been explored for a number of applications in finance and stock trading. In this paper, we present a practical implementation of Deep RL for trading natural gas futures contracts. The Sharpe Ratio obtained exceeds benchmarks given by trend following and mean reversion strategies as well as results reported in literature. Moreover, we propose a simple but effective ensemble learning scheme for trading, which significantly improves performance through enhanced model stability and robustness as well as lower turnover and hence lower transaction cost. We discuss the resulting Deep RL strategy in terms of model explainability, trading frequency and risk measures.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDomain-adapted Learning and Imitation: DRL for Power Arbitrage

Yuanrong Wang, Christian Michler, Vignesh Raja Swaminathan et al.

Interpretability Analysis of Domain Adapted Dense Retrievers

Goksenin Yuksel, Jaap Kamps

Deep Reinforcement Learning for Quantitative Trading

Jiawei Du, Zheng Tao, Zixun Lan et al.

An Application of Deep Reinforcement Learning to Algorithmic Trading

Damien Ernst, Thibaut Théate

No citations found for this paper.

Comments (0)