Authors

Summary

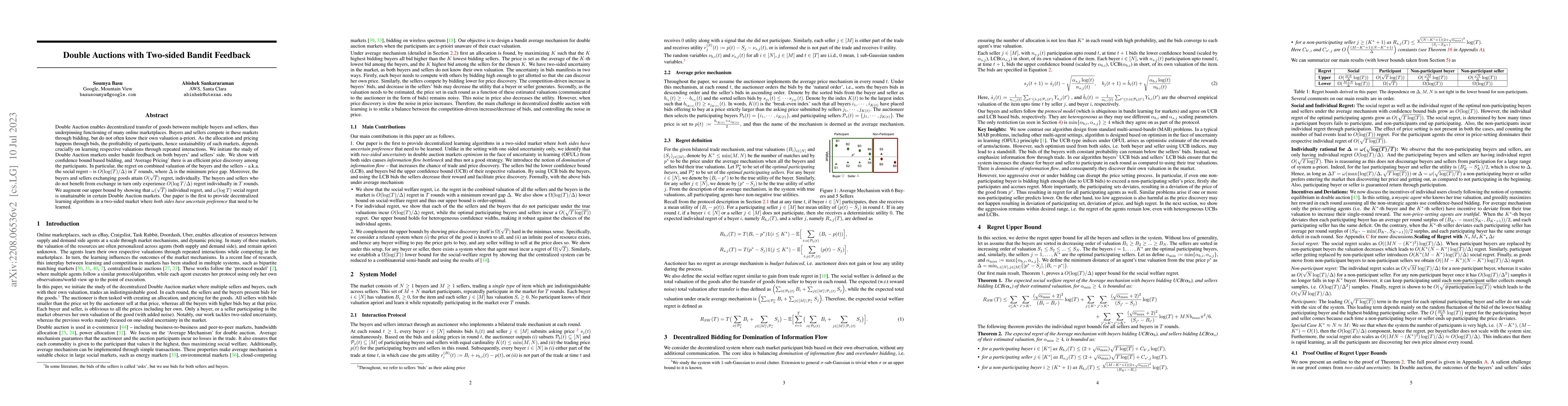

Double Auction enables decentralized transfer of goods between multiple buyers and sellers, thus underpinning functioning of many online marketplaces. Buyers and sellers compete in these markets through bidding, but do not often know their own valuation a-priori. As the allocation and pricing happens through bids, the profitability of participants, hence sustainability of such markets, depends crucially on learning respective valuations through repeated interactions. We initiate the study of Double Auction markets under bandit feedback on both buyers' and sellers' side. We show with confidence bound based bidding, and `Average Pricing' there is an efficient price discovery among the participants. In particular, the regret on combined valuation of the buyers and the sellers -- a.k.a. the social regret -- is $O(\log(T)/\Delta)$ in $T$ rounds, where $\Delta$ is the minimum price gap. Moreover, the buyers and sellers exchanging goods attain $O(\sqrt{T})$ regret, individually. The buyers and sellers who do not benefit from exchange in turn only experience $O(\log{T}/ \Delta)$ regret individually in $T$ rounds. We augment our upper bound by showing that $\omega(\sqrt{T})$ individual regret, and $\omega(\log{T})$ social regret is unattainable in certain Double Auction markets. Our paper is the first to provide decentralized learning algorithms in a two-sided market where \emph{both sides have uncertain preference} that need to be learned.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)