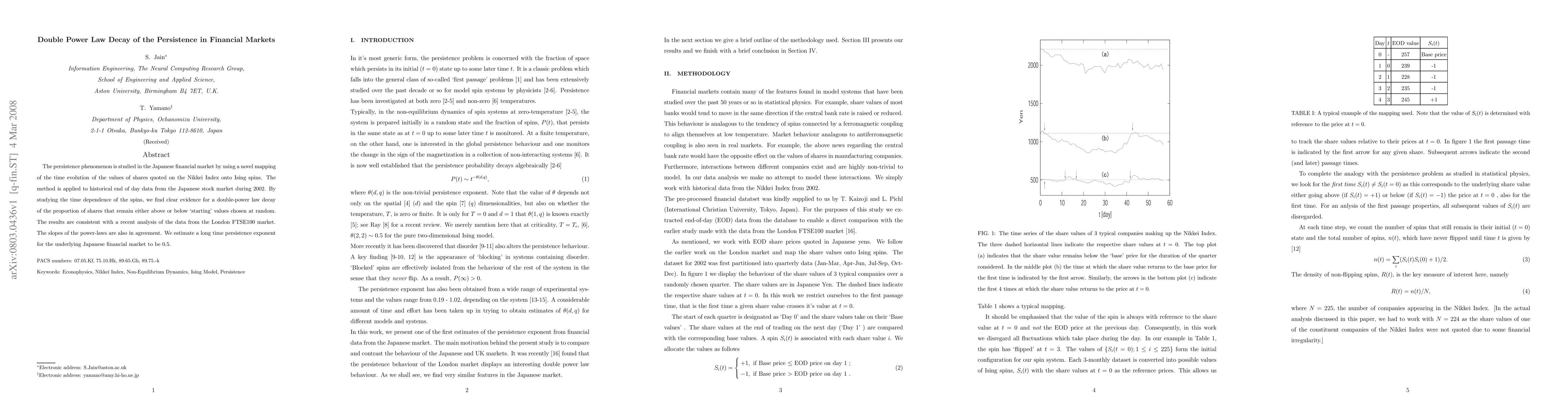

Summary

The persistence phenomenon is studied in the Japanese financial market by using a novel mapping of the time evolution of the values of shares quoted on the Nikkei Index onto Ising spins. The method is applied to historical end of day data from the Japanese stock market during 2002. By studying the time dependence of the spins, we find clear evidence for a double-power law decay of the proportion of shares that remain either above or below ` starting\rq\ values chosen at random. The results are consistent with a recent analysis of the data from the London FTSE100 market. The slopes of the power-laws are also in agreement. We estimate a long time persistence exponent for the underlying Japanese financial market to be 0.5.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)