Summary

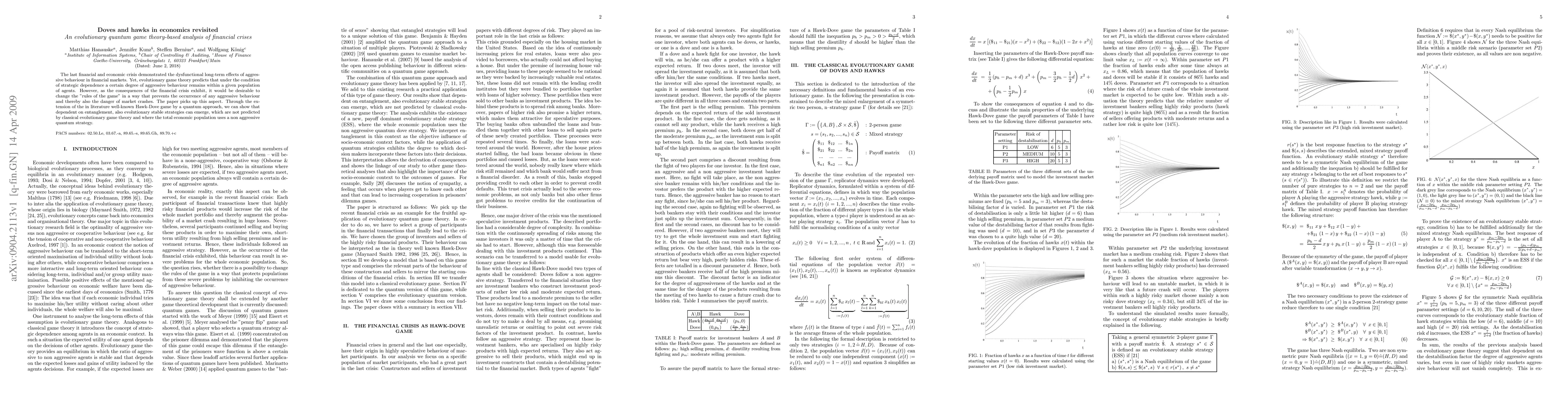

The last financial and economic crisis demonstrated the dysfunctional long-term effects of aggressive behaviour in financial markets. Yet, evolutionary game theory predicts that under the condition of strategic dependence a certain degree of aggressive behaviour remains within a given population of agents. However, as the consequences of the financial crisis exhibit, it would be desirable to change the 'rules of the game' in a way that prevents the occurrence of any aggressive behaviour and thereby also the danger of market crashes. The paper picks up this aspect. Through the extension of the in literature well-known Hawk-Dove game by a quantum approach, we can show that dependent on entanglement, also evolutionary stable strategies can emerge, which are not predicted by classical evolutionary game theory and where the total economic population uses a non aggressive quantum strategy.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep Learning Agents Trained For Avoidance Behave Like Hawks And Doves

Aryaman Reddi, Glenn Vinnicombe

GPT Deciphering Fedspeak: Quantifying Dissent Among Hawks and Doves

Denis Peskoff, Adam Visokay, Sander Schulhoff et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)