Summary

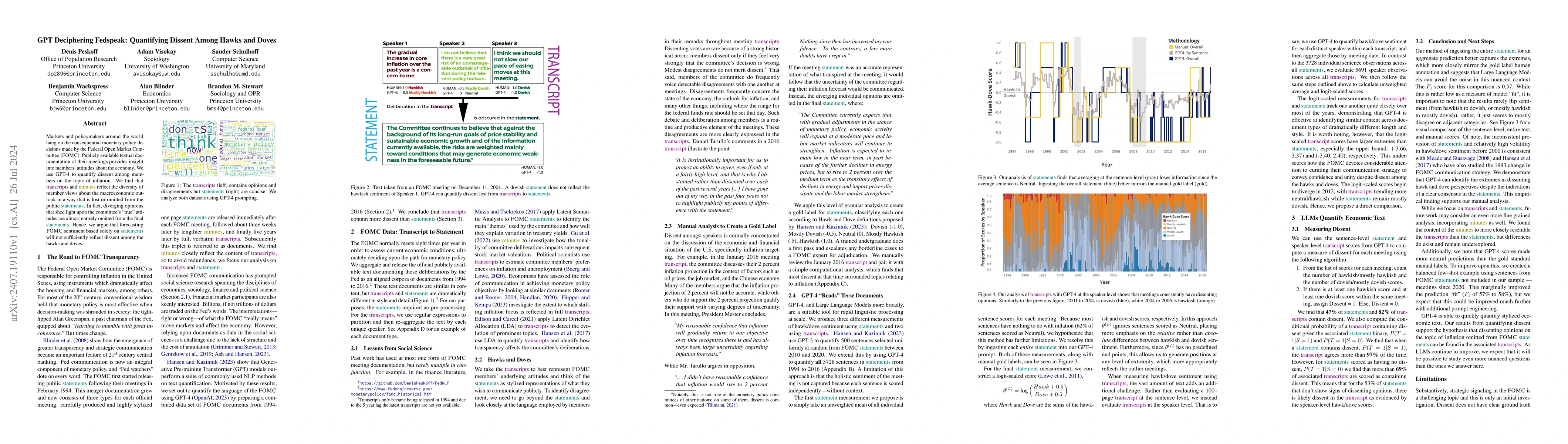

Markets and policymakers around the world hang on the consequential monetary policy decisions made by the Federal Open Market Committee (FOMC). Publicly available textual documentation of their meetings provides insight into members' attitudes about the economy. We use GPT-4 to quantify dissent among members on the topic of inflation. We find that transcripts and minutes reflect the diversity of member views about the macroeconomic outlook in a way that is lost or omitted from the public statements. In fact, diverging opinions that shed light upon the committee's "true" attitudes are almost entirely omitted from the final statements. Hence, we argue that forecasting FOMC sentiment based solely on statements will not sufficiently reflect dissent among the hawks and doves.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep Learning Agents Trained For Avoidance Behave Like Hawks And Doves

Aryaman Reddi, Glenn Vinnicombe

No citations found for this paper.

Comments (0)