Authors

Summary

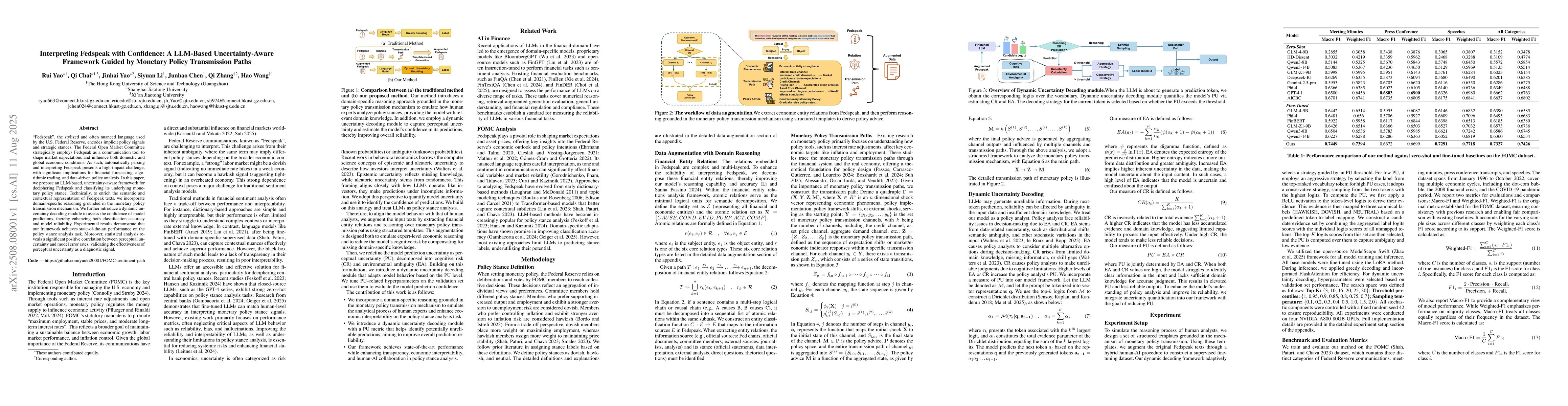

"Fedspeak", the stylized and often nuanced language used by the U.S. Federal Reserve, encodes implicit policy signals and strategic stances. The Federal Open Market Committee strategically employs Fedspeak as a communication tool to shape market expectations and influence both domestic and global economic conditions. As such, automatically parsing and interpreting Fedspeak presents a high-impact challenge, with significant implications for financial forecasting, algorithmic trading, and data-driven policy analysis. In this paper, we propose an LLM-based, uncertainty-aware framework for deciphering Fedspeak and classifying its underlying monetary policy stance. Technically, to enrich the semantic and contextual representation of Fedspeak texts, we incorporate domain-specific reasoning grounded in the monetary policy transmission mechanism. We further introduce a dynamic uncertainty decoding module to assess the confidence of model predictions, thereby enhancing both classification accuracy and model reliability. Experimental results demonstrate that our framework achieves state-of-the-art performance on the policy stance analysis task. Moreover, statistical analysis reveals a significant positive correlation between perceptual uncertainty and model error rates, validating the effectiveness of perceptual uncertainty as a diagnostic signal.

AI Key Findings

Generated Aug 12, 2025

Methodology

The paper proposes an LLM-based, uncertainty-aware framework for deciphering Fedspeak, enriching semantic and contextual representation with domain-specific reasoning based on monetary policy transmission mechanisms. It introduces a dynamic uncertainty decoding module for assessing model prediction confidence.

Key Results

- The framework achieves state-of-the-art performance on policy stance analysis tasks.

- A significant positive correlation exists between perceptual uncertainty and model error rates, validating uncertainty as a diagnostic signal.

- The method substantially improves over baselines, demonstrating effectiveness for financial sentiment analysis.

- Performance gains are particularly pronounced for meeting minutes and speeches.

- Fine-tuning improves performance for most models, though the magnitude varies significantly.

Significance

This research is significant for financial forecasting, algorithmic trading, and data-driven policy analysis by providing a reliable method for parsing and interpreting Fedspeak, which encodes implicit policy signals and strategic stances.

Technical Contribution

The paper introduces a dynamic uncertainty decoding module and incorporates domain-specific reasoning grounded in monetary policy transmission mechanisms to enhance semantic and contextual representation in LLMs for interpreting Fedspeak.

Novelty

The novelty lies in the combination of an uncertainty-aware framework with domain-specific reasoning based on monetary policy transmission paths, which significantly improves classification accuracy and model reliability for interpreting Fedspeak.

Limitations

- The approach still relies on carefully designed domain templates and faces limitations in runtime efficiency and strategy design.

- The current framework requires further enhancement to handle samples involving contextual confusion or implicit statements.

Future Work

- Addressing runtime efficiency and strategy design limitations.

- Improving the handling of contextual confusion and implicit statements.

- Exploring the integration of additional economic factors and data sources.

Paper Details

PDF Preview

Similar Papers

Found 4 papersExamining the Effect of Monetary Policy and Monetary Policy Uncertainty on Cryptocurrencies Market

Mohammadreza Mahmoudi

MAGIC: Motion-Aware Generative Inference via Confidence-Guided LLM

Yawei Luo, Ping Liu, Siwei Meng

Comments (0)