Authors

Summary

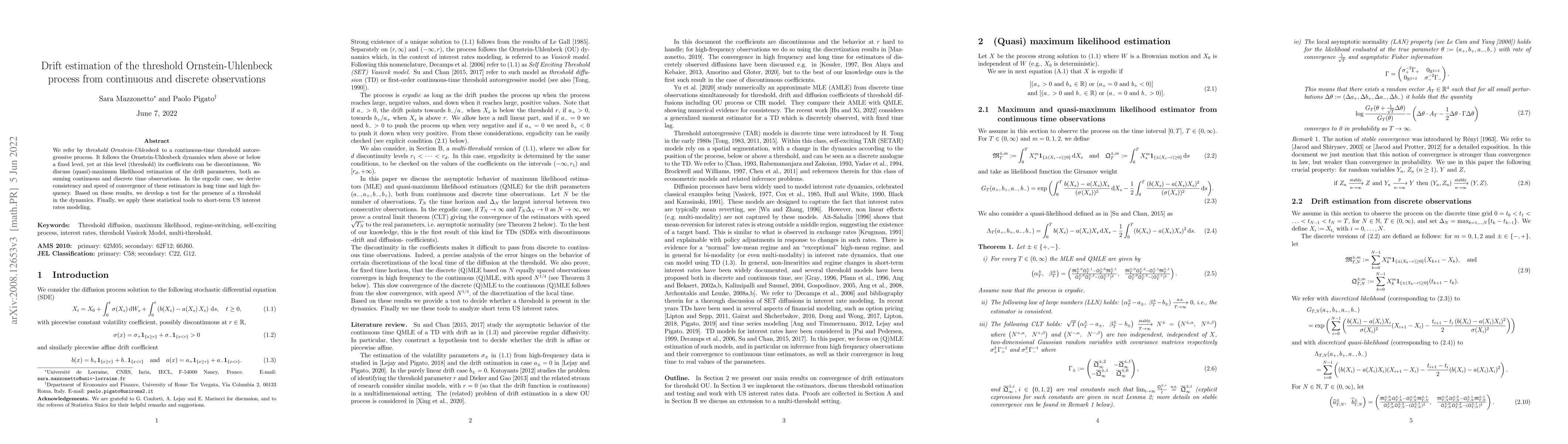

We refer by threshold Ornstein-Uhlenbeck to a continuous-time threshold autoregressive process. It follows the Ornstein-Uhlenbeck dynamics when above or below a fixed level, yet at this level (threshold) its coefficients can be discontinuous. We discuss (quasi)-maximum likelihood estimation of the drift parameters, both assuming continuous and discrete time observations. In the ergodic case, we derive consistency and speed of convergence of these estimators in long time and high frequency. Based on these results, we develop a test for the presence of a threshold in the dynamics. Finally, we apply these statistical tools to short-term US interest rates modeling.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)