Summary

For portfolio optimisation under proportional transaction costs, we provide a duality theory for general cadlag price processes. In this setting, we prove the existence of a dual optimiser as well as a shadow price process in a generalised sense. This shadow price is defined via a "sandwiched" process consisting of a predictable and an optional strong supermartingale and pertains to all strategies which remain solvent under transaction costs. We provide examples showing that in the present general setting the shadow price process has to be of this generalised form.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

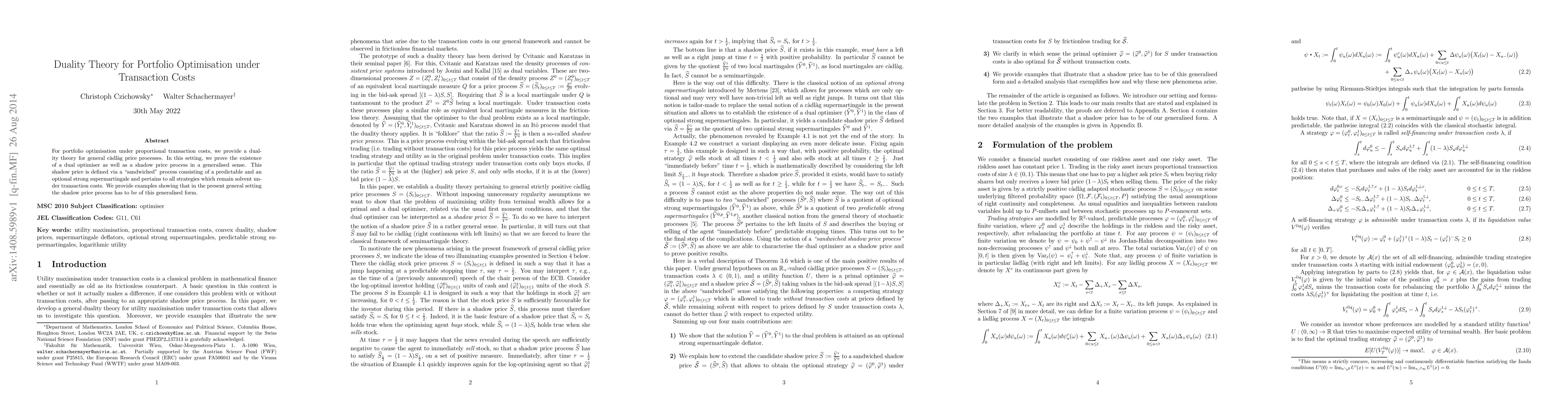

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)