Summary

We continue the analysis of our previous paper (Czichowsky/Schachermayer/Yang 2014) pertaining to the existence of a shadow price process for portfolio optimisation under proportional transaction costs. There, we established a positive answer for a continuous price process $S=(S_t)_{0\leq t\leq T}$ satisfying the condition $(NUPBR)$ of "no unbounded profit with bounded risk". This condition requires that $S$ is a semimartingale and therefore is too restrictive for applications to models driven by fractional Brownian motion. In the present paper, we derive the same conclusion under the weaker condition $(TWC)$ of "two way crossing", which does not require $S$ to be a semimartingale. Using a recent result of R.~Peyre, this allows us to show the existence of a shadow price for exponential fractional Brownian motion and $all$ utility functions defined on the positive half-line having reasonable asymptotic elasticity. Prime examples of such utilities are logarithmic or power utility.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

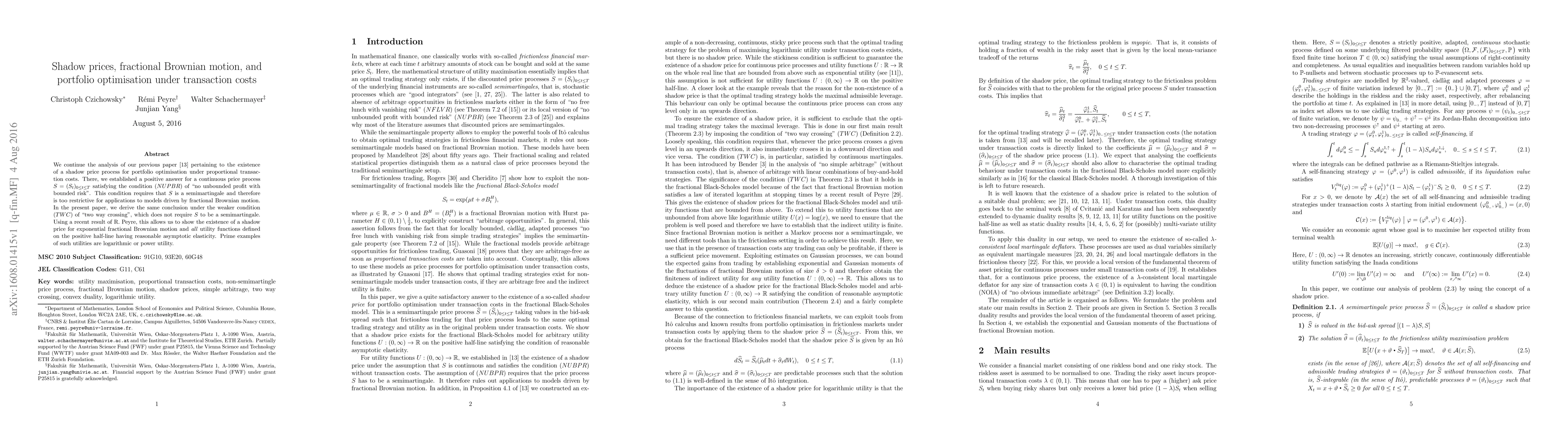

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)