Summary

While absence of arbitrage in frictionless financial markets requires price processes to be semimartingales, non-semimartingales can be used to model prices in an arbitrage-free way, if proportional transaction costs are taken into account. In this paper, we show, for a class of price processes which are not necessarily semimartingales, the existence of an optimal trading strategy for utility maximisation under transaction costs by establishing the existence of a so-called shadow price. This is a semimartingale price process, taking values in the bid ask spread, such that frictionless trading for that price process leads to the same optimal strategy and utility as the original problem under transaction costs. Our results combine arguments from convex duality with the stickiness condition introduced by P. Guasoni. They apply in particular to exponential utility and geometric fractional Brownian motion. In this case, the shadow price is an Ito process. As a consequence we obtain a rather surprising result on the pathwise behaviour of fractional Brownian motion: the trajectories may touch an Ito process in a one-sided manner without reflection.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

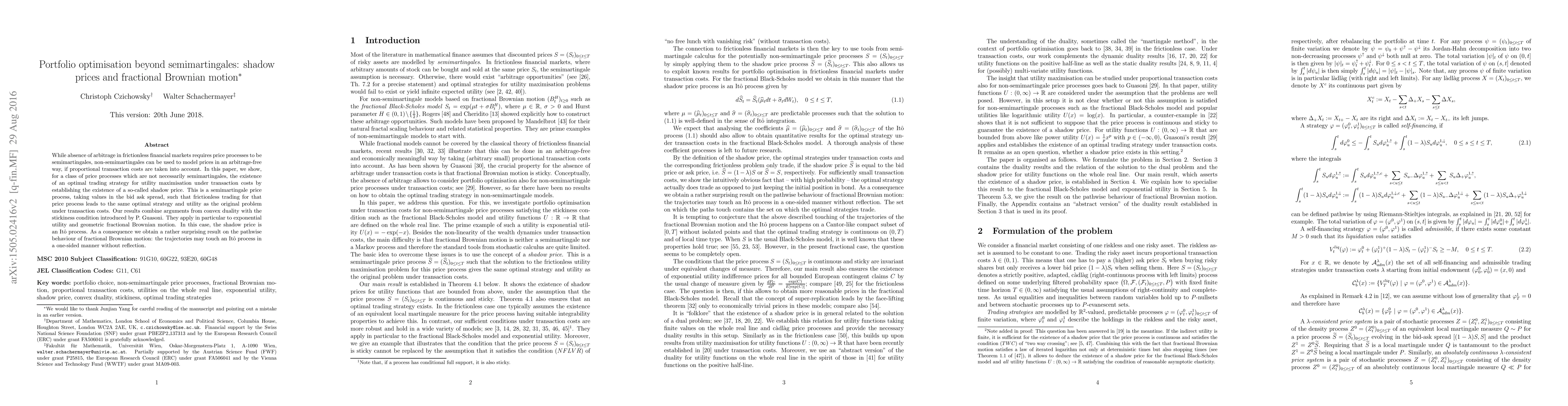

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)