Summary

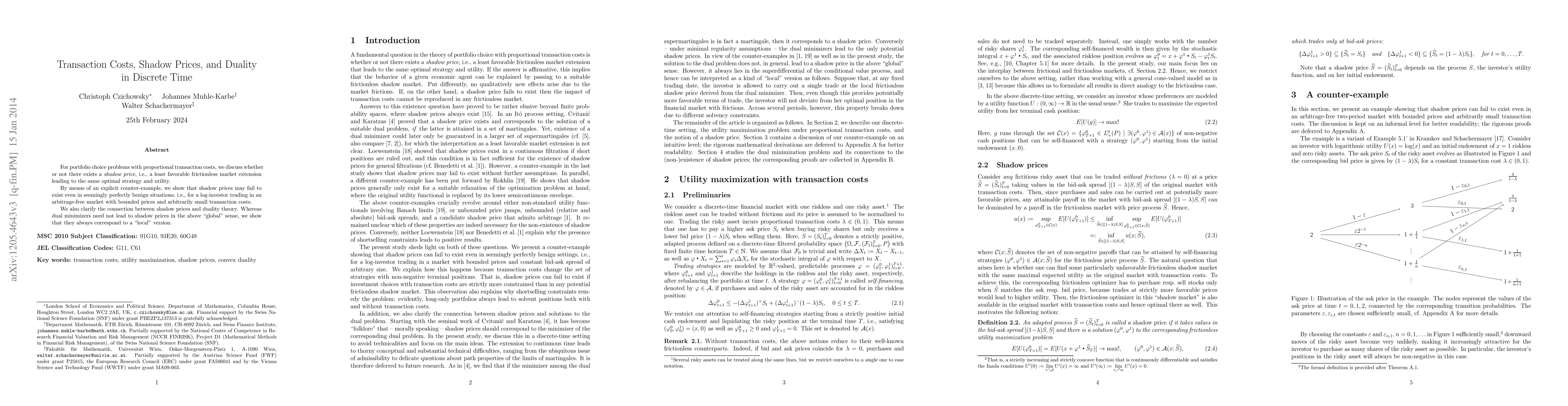

For portfolio choice problems with proportional transaction costs, we discuss whether or not there exists a "shadow price", i.e., a least favorable frictionless market extension leading to the same optimal strategy and utility. By means of an explicit counter-example, we show that shadow prices may fail to exist even in seemingly perfectly benign situations, i.e., for a log-investor trading in an arbitrage-free market with bounded prices and arbitrarily small transaction costs. We also clarify the connection between shadow prices and duality theory. Whereas dual minimizers need not lead to shadow prices in the above "global" sense, we show that they always correspond to a "local" version.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)