Authors

Summary

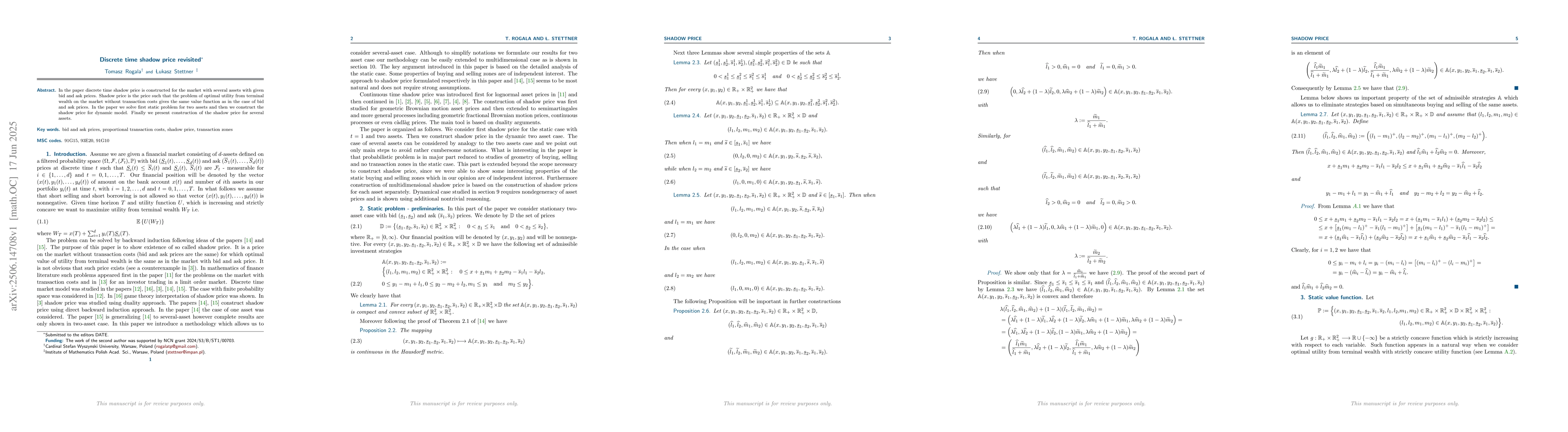

In the paper discrete time shadow price is constructed for the market with several assets with given bid and ask prices. Shadow price is the price such that the problem of optimal utility from terminal wealth on the market without transaction costs gives the same value function as in the case of bid and ask prices. In the paper we solve first static problem for two assets and then we construct the shadow price for dynamic model. Finally we present construction of the shadow price for several assets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersContinuous time analysis of fleeting discrete price moves

Neil Shephard, Justin J. Yang

No citations found for this paper.

Comments (0)