Summary

This paper studies the utility maximization on the terminal wealth with random endowments and proportional transaction costs. To deal with unbounded random payoffs from some illiquid claims, we propose to work with the acceptable portfolios defined via the consistent price system (CPS) such that the liquidation value processes stay above some stochastic thresholds. In the market consisting of one riskless bond and one risky asset, we obtain a type of super-hedging result. Based on this characterization of the primal space, the existence and uniqueness of the optimal solution for the utility maximization problem are established using the duality approach. As an important application of the duality theorem, we provide some sufficient conditions for the existence of a shadow price process with random endowments in a generalized form as well as in the usual sense using acceptable portfolios.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

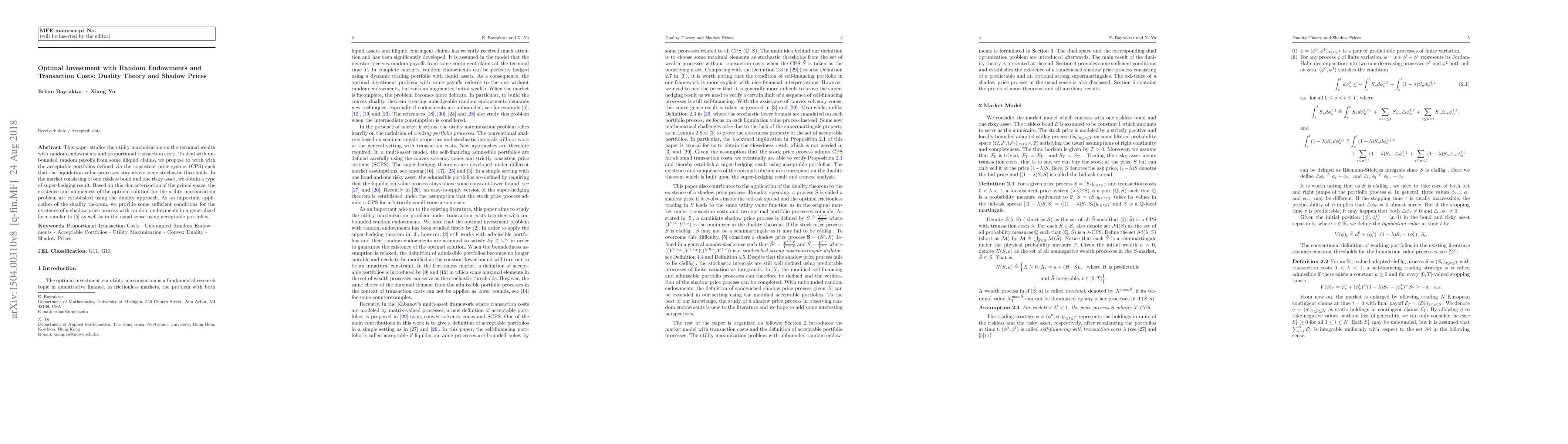

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)