Summary

This paper studies the optimal consumption under the addictive habit formation preference in markets with transaction costs and unbounded random endowments. To model the proportional transaction costs, we adopt the Kabanov's multi-asset framework with a cash account. At the terminal time T, the investor can receive unbounded random endowments for which we propose a new definition of acceptable portfolios based on the strictly consistent price system (SCPS). We prove a type of super-hedging theorem using the acceptable portfolios which enables us to obtain the consumption budget constraint condition under market frictions. Applying the path dependence reduction and the embedding approach, we obtain the existence and uniqueness of the optimal consumption using some auxiliary processes and the duality analysis. As an application of the duality theory, the market isomorphism with special discounting factors is also discussed in the sense that the original optimal consumption with habit formation is equivalent to the standard optimal consumption problem without the habits impact, however, in a modified isomorphic market model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

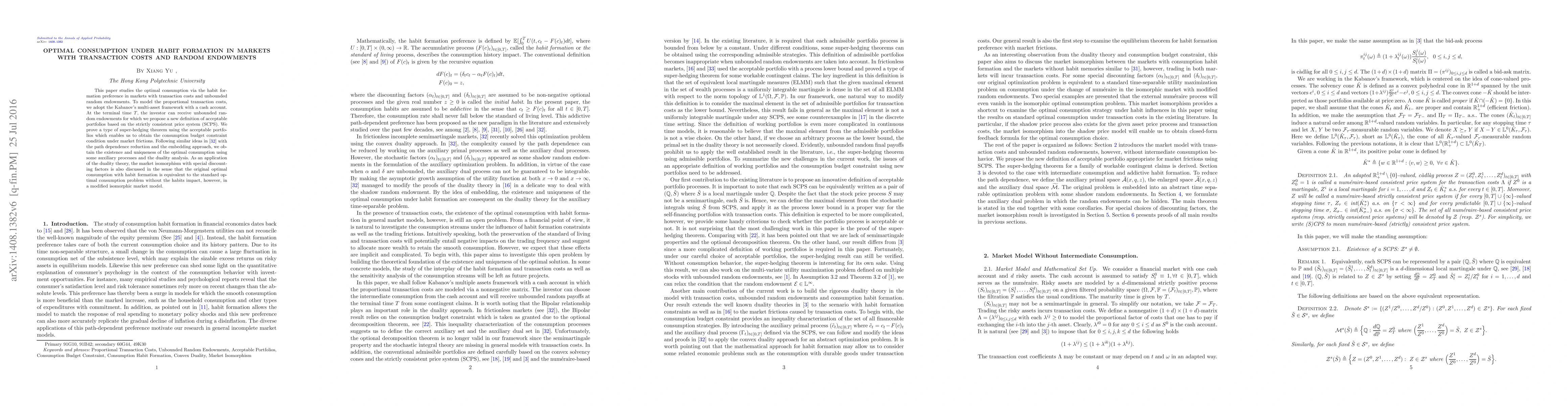

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal Investment and Consumption under a Habit-Formation Constraint

Erhan Bayraktar, Bahman Angoshtari, Virginia R. Young

| Title | Authors | Year | Actions |

|---|

Comments (0)