Authors

Summary

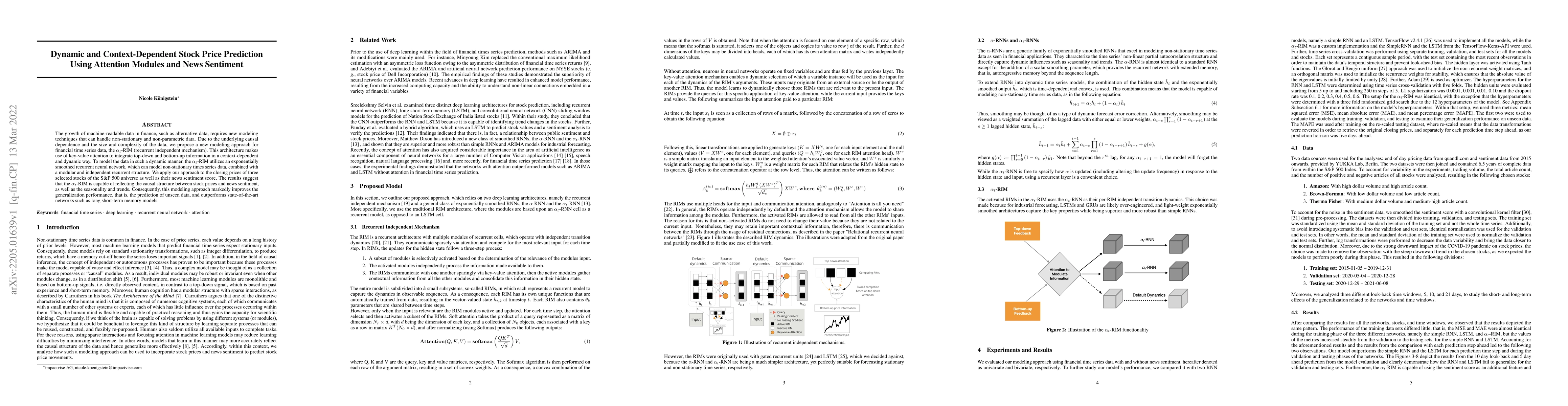

The growth of machine-readable data in finance, such as alternative data, requires new modeling techniques that can handle non-stationary and non-parametric data. Due to the underlying causal dependence and the size and complexity of the data, we propose a new modeling approach for financial time series data, the $\alpha_{t}$-RIM (recurrent independent mechanism). This architecture makes use of key-value attention to integrate top-down and bottom-up information in a context-dependent and dynamic way. To model the data in such a dynamic manner, the $\alpha_{t}$-RIM utilizes an exponentially smoothed recurrent neural network, which can model non-stationary times series data, combined with a modular and independent recurrent structure. We apply our approach to the closing prices of three selected stocks of the S\&P 500 universe as well as their news sentiment score. The results suggest that the $\alpha_{t}$-RIM is capable of reflecting the causal structure between stock prices and news sentiment, as well as the seasonality and trends. Consequently, this modeling approach markedly improves the generalization performance, that is, the prediction of unseen data, and outperforms state-of-the-art networks such as long short-term memory models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEffects of Daily News Sentiment on Stock Price Forecasting

A. Das, S. Srinivas, R. Gadela et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)